By Abiola Gbolahan

Edited By Fredrick Oladipupo

Table of Contents

1. Introduction

For many startups, accounting often takes a backseat. It’s one of those tasks that many entrepreneurs push aside until it becomes a serious problem, like cash flow issues, unpaid invoices piling up, or missed tax deadlines. But here’s the thing: setting up an effective accounting system early on can save you from these headaches down the road.

For startups, finding the right accounting software is very important. You need something affordable, scalable, and easy to use. That’s where Zoho Books accounting comes in.

While it may not have the widespread recognition of giants like QuickBooks or sage, Zoho Books is quietly powerful. It’s designed with modern startups in mind, offering flexibility, automation, and a suite of essential accounting tools without the hefty price tag.

In this blog post, we’re going to explore why Zoho Books could be the hidden gem your startup needs, from its robust features and scalability to its user-friendly interface and startup-friendly pricing. Let’s dive in.

2. Why Startups Shouldn’t Delay Setting Up Accounting

When you’re just starting a business, accounting might not seem like a top priority. After all, there are products to launch, clients to win, and marketing strategies to plan. But delaying your accounting setup can lead to serious problems down the line.

Imagine trying to track cash flow manually, only to realize you’re running low on funds when it’s too late to do anything about it. Or missing payment deadlines and damaging relationships with vendors. Or worse like scrambling to file taxes without proper records in place.

These scenarios are all too common for startups that don’t prioritize accounting from day one. But the good news? Setting up a solid accounting system early can prevent these pitfalls.

Good accounting practices can help you:

Manage cash flow effectively, so you always know how much money is coming in and going out.

Keep up with payment deadlines, avoiding late fees and strained vendor relationships.

Prepare for taxes with ease, ensuring that every transaction is properly documented and accessible.

Boost fundraising efforts, as investors prefer startups with well-maintained financial records.

Streamline audits and financial reviews, making it easier to spot potential issues before they become costly problems.

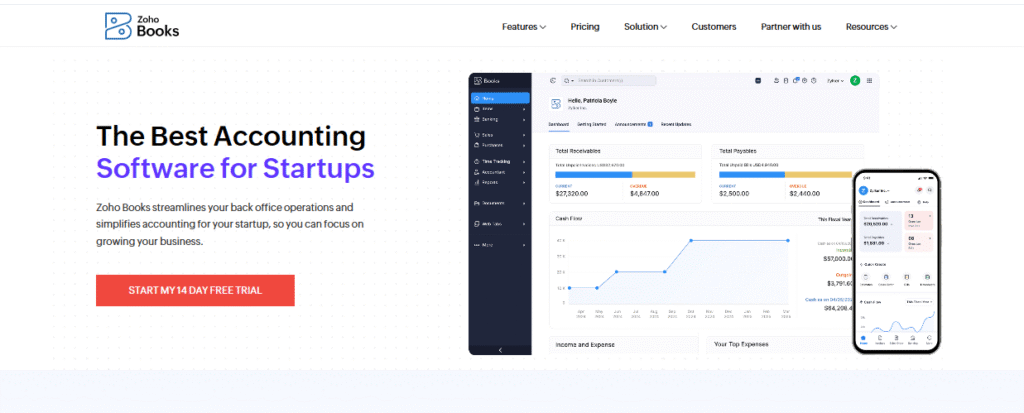

3. Quick Overview of Zoho Books

Zoho Books accounting is a cloud-based financial management software that is part of the Zoho suite, A collection of over 45 business applications designed to streamline business operations. Launched in 2011, Zoho Books accounting has gained popularity among small businesses and startups for its comprehensive set of features, including invoicing, expense tracking, tax management, and financial reporting.

Unlike mainstream accounting tools like QuickBooks and Sage, Zoho Books focuses on delivering powerful yet affordable accounting solutions for small businesses and startups. It offers essential features such as automated bank feeds, client and vendor management, and project billing which all are accessible through a single platform.

One of its biggest strengths is its global reach. Zoho Books supports multiple currencies, regional tax regulations, and compliance requirements, making it ideal for startups operating across different countries. It also includes built-in tax management for GST, VAT, and other tax structures, ensuring businesses stay compliant regardless of their location.

Additionally, Zoho Books is designed with a mobile-first approach, allowing entrepreneurs to manage their finances on the go. The app is available for iOS and Android, enabling users to send invoices, track expenses, and monitor cash flow anytime, anywhere.

4. Key Features Startups Will Love

| Feature | Description |

|---|---|

| Automated Bank Feeds | Automatically imports bank transactions, reducing manual entry and ensuring accurate records. |

| Client and Vendor Management | CRM-lite capabilities to manage all payables and receivables, keeping track of business relationships effectively. |

| Invoicing and Payment Collection | Create professional invoices, set up automatic payment reminders, and accept online payments seamlessly. |

| Expense Tracking | Capture receipts using the mobile app, categorize expenses, and monitor spending in real time. |

| Time Tracking and Project Billing | Track billable hours with built-in timers and link them to invoices for accurate client billing. |

| Inventory Management | Manage stock levels, track product movement, and monitor sales if you deal with physical goods. |

| Tax Compliance Tools | Simplify tax management with GST, VAT, and sales tax calculation, ensuring accurate tax filing. |

5. Pricing Breakdown

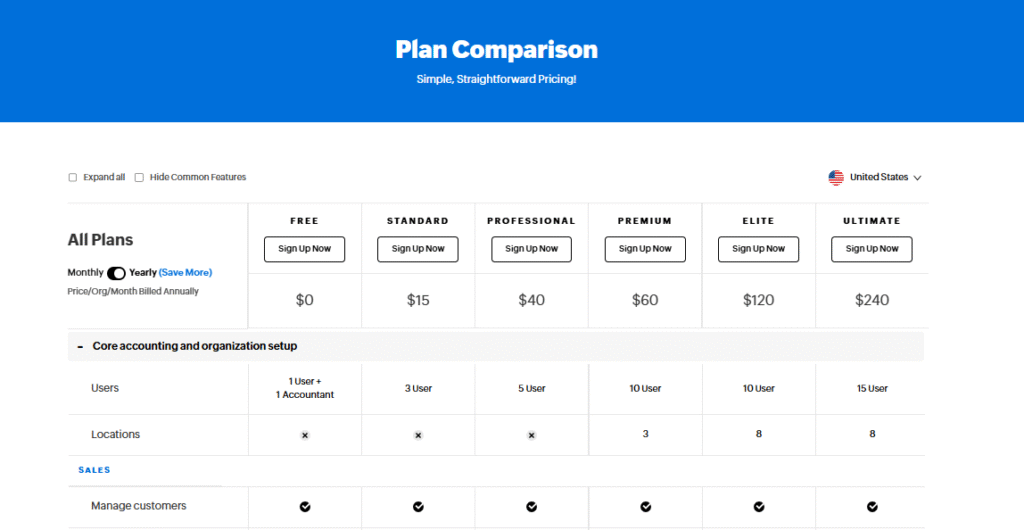

When it comes to affordability, Zoho Books stands out as one of the most cost-effective accounting tools for startups especially when compared to alternatives like FreshBooks and QuickBooks.

Zoho Books offers four core pricing tiers:

| Plan | Monthly Cost (Billed Annually) | Best For |

|---|---|---|

| Free | $0 | Solopreneurs and small businesses with revenue under $50K/year |

| Standard | $15 | Organizing transactions, accounts, and basic reporting |

| Professional | $40 | Managing projects, inventory, and purchases |

| Premium | $60 | Advanced automation and customization |

Most startups will find the Standard plan ($15/month) sufficient for everyday accounting needs, and even the Free plan is a great starting point for micro-businesses with limited revenue.

Compared to QuickBooks (starting around $30/month) or FreshBooks ($17–$55/month), Zoho Books delivers more value for less.

Plus, if you opt for annual billing, you enjoy significant discounts on all plans.

you can find the find all plans comparison below and their features.

If you’re a startup watching every dollar, Zoho Books proves that powerful accounting doesn’t have to break the bank.

6. Scalability for Growing Startups

One of the biggest strengths of Zoho Books is how well it grows with your startup. As your team expands, you can easily add more users without switching platforms. Whether you’re hiring your first finance assistant or building out a full accounting team, Zoho Books lets you scale your user access accordingly while keeping everything in one place as your needs evolve.

Beyond just accounting, Zoho Books is part of a larger ecosystem that includes tools like Zoho CRM, Zoho Inventory, and Zoho Payroll. This means you can gradually plug into these services as your operations grow, without having to invest in expensive add-ons or migrate to a new system. With advanced automation workflows built in, your business processes can stay efficient even as complexity increases.

7. Ease of Use

Zoho Books is refreshingly easy to use, even for founders with little to no finance background. The dashboard is clean, well-organized, and intuitive making it simple to navigate through invoices, expenses, reports, and more without feeling overwhelmed. Its user-friendly design and visual layout help busy startup teams stay focused and productive, with a short learning curve that means you don’t need to be an accountant to get started. Visit zoho books offical website

8. Integrations and Ecosystem

One of the biggest advantages of Zoho Books is its wide range of native integrations. It connects seamlessly with popular tools like Stripe, PayPal,and G Suite, Microsoft Office 365, allowing startups to automate workflows and streamline day-to-day tasks without relying on manual processes. These integrations make it easy to sync payments, manage documents, and connect your accounting to other critical business operations.

Beyond third-party apps, Zoho Books is part of the larger Zoho ecosystem, which means it works flawlessly with tools like Zoho CRM, Zoho Projects, Zoho Inventory, and Zoho Payroll. As your startup grows, you can plug into these tools to build a fully integrated business management system without needing to jump between platforms.

9. Real Startup Success Stories

Zoho Books isn’t just packed with features, it’s actually being used by real startups to solve real problems. Here is what TAHER ALAMI, the Founder, ABWEB, UAE said about zoho books

“Zoho Books makes it easy to create an quote from my smartphone right after a meeting or a call. It’s simple to set up, fully customizable, and has a user friendly interface. Now all I have to do is, focus on my core business for better productivity. “

TAHER ALAMI

Founder, ABWEB, UAE

Zoho Books offers an easy way to track expenses, send professional invoices, and keep all client billing in one place. It’s clear that no matter the industry or size, Zoho Books can flexibly adapt to a startup’s growing needs. GNANA SHEKARAN testified to this.

”Being a startup I always wanted my business accounts done in a systematic manner, which I believe is definitely a key to success. I was lagging and struggling with the accounts of my business for two years. Later we found Zoho Books and that kickstarted my business once again with more efficiency and better technology.”

GNANA SHEKARAN,

Director, Arclights Power Solutions Pvt Ltd-OPC (ALPS), Chennai, India

10. Pros and Cons

| Pros | Cons |

|---|---|

| Very affordable | Fewer accountant/CPA integrations |

| Excellent mobile apps | Less popular in the U.S. market |

| Easy automation features | Limited payroll support in some regions |

| Part of the larger Zoho suite | Slight learning curve for advanced features |

| Supports multi-currency and taxes |

11. Conclusion

When it comes to startup accounting, Zoho Books is truly a hidden gem. It may not have the same name recognition as QuickBooks, but what it offer especially for early-stage businesses is impressive. With its perfect balance of affordability, powerful features, and scalability, Zoho Books gives startups everything they need to manage their finances without draining their limited resources. From automated invoicing and tax tools to mobile-first design and integrations with popular business apps, it’s a platform built with modern entrepreneurs in mind.

If you’ve enjoyed this breakdown, you might also want to check out some of my other useful posts for freelancers and startup owners, such as:

Google Workspace vs Microsoft365: Which is Better for Businesses?, Keeper Tax For Freelancers: How to Save Big on Keeper

Lendio Business Loans: Unlocking Freelance/Business Funding.

And if you’re into tools and tech, don’t miss Vibe Coding AI: The Future of Software Development or the comparison guide FreshBooks vs Wave: Which Invoicing Software is Best for Freelancers.

Before you spend big bucks on accounting, give Zoho Books a shot — it might just save you thousands as you scale.

Pingback: Survicate vs Typeform: Best for User Research & Feedback Loops - Platform Adviser

Pingback: Refiner vs AskNicely Compared: Which Feedback tools is the Best?