Table of Contents

- Introduction

- Company Background & Market Reach

- Pricing & Fees

- Ease of Use

- Payment Methods

- Integration & Customization

- Security Features

- Mobile & In-Person Payment Options

- Customer Support & Resources

- Which Platform Is Better for Small Businesses in 2024?

- Conclusion: Final thoughts on selecting the best payment platform.

1. Introduction

In today’s fast-paced digital world, choosing the right payment platform can make or break your business – Stripe vs Paypal. PayPal and Stripe are two of the most trusted names in online payments, each offering unique benefits and features that cater to different business needs. But when it comes to small businesses in 2024, which platform truly stands out? In this detailed comparison, we’ll dive into transaction fees, ease of use, payment options, and more to help you decide: PayPal vs Stripe—Which payment solution is best for your business growth and bottom line?

Stripe and PayPal stand out as two of the leading online payment platforms globally, providing essential services for businesses of all sizes. Stripe, known for its developer-friendly design, offers flexible payment solutions tailored for online businesses, while PayPal, with its recognizable brand and trusted reputation, is widely used by consumers and businesses alike.

Choosing the right payment gateway is essential for small businesses, as it directly affects customer experience, payment security, and even revenue. A reliable payment platform not only builds customer trust but also simplifies financial management and supports business growth.

Today, we’ll explore the key aspects of Stripe and PayPal, focusing on pricing, ease of use, integration options, and more. This will help small business owners understand which platform may best fit their specific needs and priorities.

If you simply want to the verdict Click here Jump to Conclusion and Final Verdict

2. Stripe vs Paypal – Background History

2.1.1 History and Reputation of Stripe

Stripe was founded in 2010 by two brothers, Patrick and John Collison, with the idea of making online payments easier for businesses. Their focus was on creating a system that was easy for developers to set up and integrate into websites, this helped them stand out from older payment services.

By offering a simple, developer-friendly tool, Stripe quickly gained popularity, especially among tech companies and online businesses. Big companies like Amazon, Shopify, and Google also use Stripe for their payments, boosting its reputation as a reliable and trusted platform .

2.1.2 Geographic Availability

As of 2024, Stripe operates in more than 46 countries, including many in North America, Europe, and the Asia-Pacific region. Recently, it’s been expanding into newer areas, like parts of the Middle East and Africa. This broad reach allows businesses from different regions to use Stripe to grow their operations globally without needing separate systems for international payments .

2.1.3 Popularity Among Small Businesses

Stripe is popular among small businesses, startups, and freelancers. Majorly because of its ease of use and clear pricing. Small businesses appreciate its tools, like one-click checkout, subscriptions, and multi-currency support, which make it easier to manage online payments and sales. Stripe’s easy setup and helpful features have made it especially popular with smaller businesses that don’t want to deal with complicated payment systems .

2.1.4 Current Market Share in 2024

In 2024, Stripe holds a strong position in the online payment processing market, with an estimated global market share of around 17%. This makes it one of the biggest players next to PayPal. Stripe is especially popular with e-commerce and tech companies, and it continues to grow as it adds more features, like financial tools and tax management, to attract even more businesses .

2.2.1 History and Reputation of PayPal

On the other hand, PayPal started in 1998 as Confinity, a company focused on creating security software for handheld devices. In 2000, Confinity merged with X.com, an online banking company founded by Elon Musk. The combined company soon shifted entirely to digital payments and re-branded as PayPal in 2001. PayPal quickly gained popularity as an easy way for people to make secure online payments.

In 2002, it went public and was acquired by eBay, where it became the main payment system for eBay transactions. Today, PayPal is a leading global payment platform, known for its secure, reliable, and convenient services. It’s widely trusted, especially for online purchases, and is recognized worldwide.

2.2.2 Geographic Availability

As of 2024, PayPal is available in over 200 countries and supports more than 25 currencies, giving it one of the widest reaches of any payment platform. This extensive availability makes it easier for businesses to accept payments from customers around the world. PayPal’s global reach has been key to its success, especially for businesses looking to reach international customers.

2.2.3 Popularity Among Small Businesses

PayPal is popular with small businesses because it’s simple to set up and doesn’t require extensive technical skills. Many small businesses appreciate that PayPal is widely recognized by consumers, which can help build trust. It’s also equipped with features that small businesses find useful, like easy invoicing, multi-currency support, and options for recurring payments. Additionally, PayPal offers financing and working capital loans, which help small businesses manage cash flow.

2.2.4 Current Market Share in 2024

PayPal is the most popular payment platform. It holds the largest shares of the digital payments market, estimated to be around 37-45%. Its large user base and widespread reputation make it a preferred choice for many businesses and consumers, especially for e-commerce transactions. While competition with platforms like Stripe and Square is growing, PayPal remains a dominant force in digital payments worldwide.

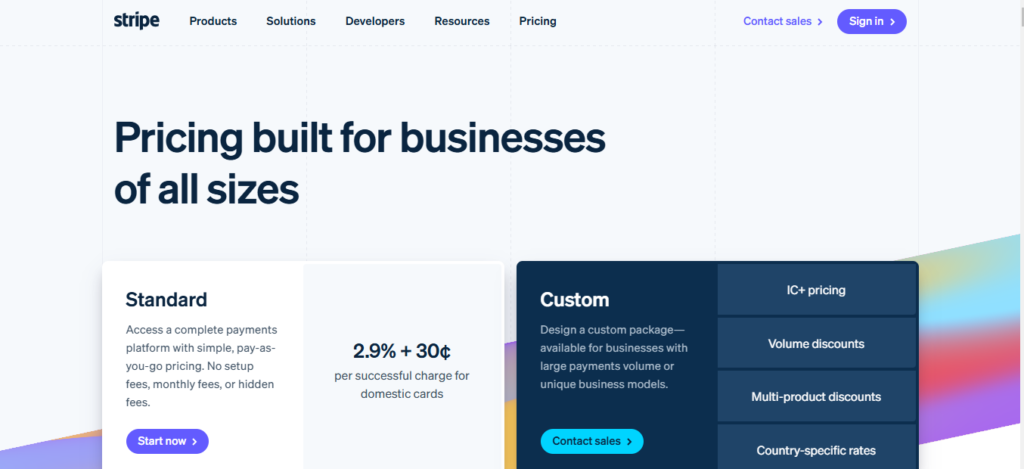

3. Pricing & Fees: Stripe vs PayPal

3.1 Transaction Fees

Both Stripe and PayPal charge transaction fees, though the rates differ slightly. Stripe’s domestic transaction fee within the U.S. is 2.9% + 30 cents per successful card transaction, whereas PayPal’s rate is 3.49% + 49 cents. For international transactions, both platforms add an extra cost; Stripe charges an additional 1% plus a 1% currency conversion fee if applicable, while PayPal adds a 1.5% fee, along with an additional 3-4% currency conversion charge. This difference can make Stripe more cost-effective for international transactions, especially for businesses handling larger or frequent global sales.

3.2 Monthly Fees

When it comes to monthly fees, Stripe and PayPal offer flexibility. Stripe has no monthly fees, making it attractive to small or new businesses without a consistent transaction volume. PayPal, similarly, has no monthly fees for its standard Business account but charges $25 monthly for PayPal Payments Pro. This premium service provides extra features and customization, which can be valuable for high-volume businesses seeking tailored payment options.

3.3 Hidden Fees

For charge-backs, Stripe and PayPal apply fees of $15 and $20, respectively. Both companies do not refund the original transaction fee on refunds, potentially impacting businesses with a high refund rate. PayPal’s currency conversion rates, which vary from 3-4%, can add up for businesses handling international transactions, giving Stripe an advantage in situations requiring multiple currencies.

3.4 Best Fit for Businesses with Varying Transaction Volumes

Stripe is often the better fit for businesses with higher transaction volumes or those heavily focused on international sales, thanks to its lower international fees and lack of monthly charges. However, PayPal is ideal for smaller businesses or those targeting customers who value PayPal’s secure, trusted brand. Its no-monthly-fee Business option and wide recognition make it popular among small to medium-sized businesses, even though the fees for international transactions are higher.

4. Ease of Use: Stripe vs PayPal

4.1 User Experience and Interface

Stripe has a sleek, modern interface that’s highly customizable, though it may feel more technical to those new to online payment systems. PayPal’s interface, while simpler, is familiar to most users and straightforward, with clear navigation for both buyers and sellers. This makes PayPal slightly more beginner-friendly for small business owners.

4.2 Onboarding Process for Small Businesses

Stripe’s onboarding is designed for developers and offers in-depth customization options during setup, but this can feel a bit complex for non-technical users. In contrast, PayPal’s onboarding is quick and user-friendly. Businesses can get set up in minutes with a simple account creation process, making PayPal accessible for small business owners with minimal setup time.

4.3 Dashboard Features and Reporting

Stripe’s dashboard is powerful, offering detailed analytics and insights, which is helpful for businesses tracking sales and performance. PayPal’s dashboard is simpler and easy to navigate, providing essential tools like transaction history and basic reporting. For advanced reporting, Stripe tends to offer more depth, but PayPal’s simplicity works well for small business needs.

4.4 Ease for Non-Technical Business Owners

Stripe, while powerful, may require some technical knowledge for setup and customization, especially if you want to integrate it deeply into your website. PayPal, on the other hand, is ready-to-use for non-technical users, requiring minimal effort to add payment options to a website or app.

5. Payment Methods Supported: Stripe vs PayPal

5.1 Stripe Payment Methods

Stripe supports a wide variety of payment methods, including major credit and debit cards like Visa, Mastercard, American Express, and Discover. Stripe also integrates with popular digital wallets such as Apple Pay, Google Pay, and Samsung Pay. Additionally, it supports various regional payment methods like SEPA Direct Debit in Europe, iDEAL in the Netherlands, and Ali-pay in China, making it adaptable for businesses with international customers.

5.2 PayPal Payment Methods

PayPal allows users to make payments with major credit and debit cards, including Visa, MasterCard, and American Express. It also supports payments through PayPal’s own digital wallet, one of the most widely recognized digital wallets globally. PayPal users can also use Venmo (in the U.S.) and PayPal Credit for financing. Although PayPal doesn’t support as many local payment methods as Stripe, its integration with popular options like bank transfers and PayPal wallet provides flexibility for many businesses.

5.3 Global and Local Payment Methods

Stripe is recognized for its extensive support of local payment methods, particularly helpful for businesses targeting specific regions. In Europe, for instance, Stripe supports Bancontact, Giropay, and others, while in Asia, it offers payment options like Alipay and WeChat Pay. PayPal, by contrast, relies more heavily on credit/debit cards and its own wallet but does support local currencies, making it usable globally without as many region-specific options.

5.4 Handling International Transactions and Currencies

Stripe handles international transactions efficiently, offering businesses the ability to accept payments in over 135 currencies. It automatically converts foreign currencies for a 1% fee and adds an additional 1% for certain international cards. PayPal supports payments in over 25 currencies, though its currency conversion fees, ranging from 3-4%, can make international payments slightly more costly. Both platforms handle cross-border transactions, but Stripe’s broader currency support and lower conversion fees make it a better fit for businesses with frequent international sales.

6. Integration & Customization: Stripe vs Paypal

6.1 Integration with E-commerce Platforms

Stripe and PayPal both offer robust integration with popular e-commerce platforms, including Shopify, WooCommerce, Magneto, and BigCommerce. Stripe is often chosen by developers and businesses needing advanced integration options, as it connects seamlessly with many platforms and provides specialized plugins for e-commerce.

Likewise, PayPal integrates well with major e-commerce platforms, and its recognizable brand can be a trust signal for customers. Both Stripe and PayPal are widely supported by e-commerce platforms, but Stripe’s deep integration options may be more advantageous for businesses with specific complex needs.

6.2 API Documentation – Stripe vs Paypal

Stripe is known for its highly developer-friendly API, which offers extensive documentation and customization options. Its API was designed to be flexible and easy to use, allowing developers to create unique payment solutions tailored to their businesses.

PayPal also offers a powerful API, but it is generally considered less flexible than Stripe’s. Stripe’s API is preferred by developers looking to create custom solutions or integrate with unique systems, whereas PayPal’s API, while effective, is often simpler and less adaptable for highly customized needs.

6.3 Pre-Built Tools and Plugins

Both Stripe and PayPal provide pre-built tools and plugins, which simplify integration with popular e-commerce platforms and content management systems. Stripe offers tools such as Stripe Checkout and Stripe Elements, which allow businesses to implement secure, customizable payment forms.

PayPal provides similar options with its PayPal Checkout, as well as plugins for WordPress, WooCommerce, and other platforms. These pre-built tools help businesses get set up quickly without the need for custom code, but Stripe’s options are often considered more customizable for those who need specific design or functionality.

6.4 Customization Options for Checkout Flows

Stripe excels in customization, offering extensive options to control the look and feel of the checkout experience. With Stripe Elements, businesses can build a fully customized checkout form to match their brand, while Stripe Checkout provides a simpler, hosted option that is still customizable to some extent. PayPal also allows customization, though it is more limited compared to Stripe. Businesses can add branding elements like logos and colors, but PayPal’s checkout flow has fewer customization options, which may limit the ability to create a seamless brand experience.

So, Stripe’s flexibility in integrations and customization options make it ideal for developers and businesses needing a unique, tailored solution. PayPal, while less flexible, is easy to set up and recognizable for users, making it a strong choice for businesses that prioritize simplicity over extensive customization.

7. Security Features: Stripe vs Paypal

7.1 Overview of Security Measures, Fraud Detection, and Encryption

Both Stripe and PayPal prioritize secure transactions through advanced encryption and fraud detection measures. Stripe uses AES-256 encryption for card data and supports dynamic encryption on its network, securing all sensitive information. Its Radar fraud prevention tool, powered by machine learning, detects and blocks fraudulent transactions in real time, which is customizable for businesses to set specific fraud rules.

Similarly, PayPal encrypts data with TLS (Transport Layer Security) and uses various security protocols to protect user information. PayPal also employs advanced risk models to detect suspicious activities and provides automatic account monitoring to safeguard users against unauthorized access .

7.2 PCI Compliance and Buyer Protection Features

Stripe and PayPal are both PCI-DSS (Payment Card Industry Data Security Standard) compliant, meaning they adhere to industry standards for securely handling payment information. Stripe provides automatic PCI compliance for all users and offers a range of tools to simplify compliance for merchants, such as hosted payment pages that minimize sensitive data exposure.

Likewise, PayPal maintains PCI compliance and provides buyer protection on eligible purchases, which can be an advantage for businesses that want to offer customers added reassurance. This protection can include refunds for goods not received or items significantly different from their descriptions.

7.3 Chargebacks and Dispute Resolution

When it comes to chargebacks and disputes, both platforms have their own processes and associated fees. Stripe charges a $15 fee per chargeback, although this fee is refunded if the business wins the dispute. Stripe’s dashboard also provides tools for managing disputes, allowing businesses to upload evidence and communicate with Stripe’s support during the dispute process .

PayPal charges a $20 fee for chargebacks and provides a Resolution Center where businesses can manage disputes, respond to claims, and upload supporting documents. PayPal’s buyer protection can sometimes result in more customer-initiated disputes, though the platform aims to mediate fairly for both parties.

8. Mobile & In-Person Payment Options: Stripe vs Paypal

8.1 Mobile Payment Features and Apps

Stripe and PayPal both offer mobile payment solutions tailored for businesses needing flexibility. Stripe Terminal allows businesses to accept in-person payments with customizable options that integrate with mobile apps.

On the other hand, PayPal provides an app and card reader for accepting mobile payments quickly, particularly useful for small or mobile businesses. Both apps support various card types and digital wallets, making mobile transactions smooth.

8.2 POS Systems and Hardware Support

Stripe Terminal offers a range of POS hardware options, which businesses can customize based on needs, from portable readers to counter top setups.

PayPal offers similar hardware, including the PayPal Zettle reader, which works seamlessly with the PayPal app for in-person transactions. Stripe’s hardware is often seen as more flexible for custom POS setups, while PayPal’s simpler setup works well for straightforward point-of-sale use.

8.3 Best for In-Person Payments

For businesses focused heavily on in-person sales, PayPal tends to be more accessible, especially for smaller businesses needing quick setup. Stripe’s in-person payment options are often better suited for larger or highly customized retail setups, where integration with an existing system is beneficial.

9. Customer Support & Resources: Stripe vs Paypal

9.1 Availability and Quality of Customer Support

Stripe and PayPal both offer customer support to help small businesses, though the scope and quality can differ. Stripe provides 24/7 email and live chat support to all users, with phone support available for specific plans, making it accessible for troubleshooting at any time.

PayPal, on the other hand, offers phone and email support, though 24/7 access is primarily available to higher-tier business accounts. PayPal’s support is widely accessible, but users often report varying response times, especially during peak hours.

9.2 Support Channels

9.2.1 Stripe Support channels

Stripe offers live chat, email, and phone support options, along with a comprehensive help center. Their live chat is known for quick response times, making it convenient for businesses needing fast assistance.

9.2.2 Paypal Support channels

PayPal provides similar options, including phone support, email, and a community forum where users can troubleshoot with peers. However, PayPal’s live chat is only available during certain hours, which may be less convenient for international businesses.

9.3 Availability of Resources

Stripe has extensive documentation, tutorials, and guides geared toward both developers and business owners, making it easy to understand complex integrations and features. Stripe’s resources are detailed and user-friendly, often favored by businesses with technical teams.

PayPal also offers an extensive knowledge base, video tutorials, and community forums. While PayPal’s resources are accessible and useful for most users, Stripe’s documentation is often considered more comprehensive for custom solutions and complex setups.

9.4 Which Platform Offers Better Help for Troubleshooting Issues

Overall, Stripe is frequently rated higher for troubleshooting support due to its round-the-clock availability, quick response times, and developer-friendly resources. For small businesses seeking straightforward solutions, PayPal’s support can be efficient, especially with its community forums and basic troubleshooting guides. However, Stripe’s combination of robust documentation and real-time chat support makes it ideal for businesses with more complex needs.

10.Which Platform Is Better for Small Businesses in 2024?

10.1 Pros and Cons: Stripe vs Paypal

| Feature | Stripe | PayPal |

|---|---|---|

| Transactions fee | Competitive, with better rates for international transactions | Simple fees but higher for international and currency conversions |

| Ease of use | Developer-friendly but can be complex for non-technical users | Easy setup, beginner-friendly, straightforward for non-technical users |

| Payment methods | Supports diverse global and local payment methods, including Apple Pay, Google Pay | Major cards, PayPal wallet, Venmo (U.S.), limited local methods |

| Customization | Extensive options for custom checkout and integrations | Limited customization; more out-of-the-box setup |

| POS hardware | Flexible options with Stripe Terminal for custom setups | Simple, ready-to-use POS with Zettle for quick in-person payments |

| Customer support | 24/7 live chat and extensive documentation, ideal for complex troubleshooting | Accessible phone and email support; community forum but varying response times |

| Security | Strong fraud detection with Stripe Radar, PCI-compliant | Secure with buyer protection and chargeback support, PCI-compliant |

| Global reach | Accepts 135+ currencies, wide support for international payments | Accepts 25+ currencies, more recognized globally but fewer local payment methods |

10.2 Recommendations Based on Business Needs

E-commerce Businesses: Stripe is often the better choice for e-commerce due to its flexibility, global reach, and support for diverse payment methods, which is essential for businesses with international customers.

Service-Based Businesses: PayPal may suit service-based businesses better, especially those that need straightforward invoicing and recurring billing. PayPal’s brand recognition also helps build trust with clients.

Global Reach: Stripe provides greater flexibility for international transactions with lower conversion fees and a wider range of supported currencies, making it ideal for businesses targeting global customers.

Small or Non-Technical Businesses: PayPal’s ease of setup and simplicity make it suitable for small or non-technical business owners who want to get started quickly without needing extensive customization.

10.3 Overall Verdict

In 2024, both Stripe and PayPal provide significant value, but Stripe offers better flexibility, lower fees on international transactions, and extensive customization options, which makes it a strong choice for e-commerce and global businesses. PayPal remains an excellent choice for small, service-based, or local businesses that value ease of use and brand recognition. Ultimately, the best choice depends on the business’s needs, but Stripe’s adaptability and international reach offer more potential for growth and scalability.

11. Conclusion: Stripe vs Paypal

The best choice all boils down to what’s most important to you and what stage of growth your business is in.

If you’re a small online business or startup, PayPal is a good choice because it’s easy to set up a business account and get started quickly. Stripe is a better fit for large, established businesses because it provides more complex options for payment customization.

There’s also the option of using both PayPal and Stripe together, which gives your customers the ability to choose how they’d prefer to pay and gives your business a better chance of capturing revenue. However, having two payment gateways is more complicated to set up and manage and is not advisable for smaller companies.

You currently can’t integrate PayPal with Stripe, so you would need to have two merchant accounts and two sets of integrations with some of your other tools and services. This setup is more costly to maintain.

Focus on the features and the price points that your business needs most—not just now, but in the future too.

You might also needs to check out between Paystack and Flutterwave to decide which platform fit your business needs the most.

Pingback: Zoho Books Accounting: The Best Startup Software Nobody Talks ..

Pingback: FreshBooks vs Wave: Best Invoicing Software for Freelancers

Pingback: Shopify vs WooCommerce Comparison: Which One is the Best? - Platform Adviser

Pingback: Wix vs WordPress: Which Website Builder Is Right for You?

Pingback: Notion vs Evernote Comparison: Best Productivity Tool in 2025 ?

Pingback: Sage vs QuickBooks: Which Software is Best for Your Business?