Table of Contents

- Introduction

- Overview

- 2.1 Sage Overview

- 2.1.1 Background on Sage

- 2.1.2 Main business Focus

- 2.1.3 Key Features of Sage

- 2.2 QuickBooks Overview

- 2.2.1 Background on QuickBooks

- 2.2.2 Main Business Focus

- 2.2.3 Key Features of QuickBooks

- 2.1 Sage Overview

- Pricing Plan Comparison

- User Interface and Ease of Use

- Features Comparison

- Integration and Add-ons

- Mobile App Experience

- Customer Support and Resources

- Pros and Cons

- Conclusion-Ideal Use Cases

1. Introduction

Choosing the right accounting software is crucial for businesses aiming to streamline their finances, manage expenses, and simplify tax filing. In 2024, Sage and QuickBooks remain two of the most popular options, but which one is best suited to your business needs? Whether you’re running a small startup or an established business, the right accounting platform can save you time, reduce errors, and offer real-time insights into your financial health.

In this comprehensive comparison, we’ll explore the key features, pricing, and usability of Sage and QuickBooks to help you determine which software is the perfect fit for your business. Likewise, We breakdown the strengths and weaknesses of both accounting software to help you find the perfect fit for your business needs.

What is an Accounting Software?

Accounting software are tools that help businesses manage their finances easily by automating tasks like tracking expenses, handling invoices, and managing payroll. It simplifies keeping financial records and cuts down on errors.They helps small businesses stay organized, make better financial decisions, and focus on what really matters—business growth.

2. Overview-Sage vs QuickBooks: Which Software is Best for Your Business?

2.1 Sage Overview

2.1.1 Background on Sage

Sage was founded in 1981 by David Goldman, Paul Muller, and Graham Wylie in the UK. Initially, they created basic accounting software for small businesses. Through acquisitions of several Europe and North America companies in the 1990s, Sage expanded globally. In 2017, it launched Sage Business Cloud, allowing businesses to manage finances online. Today, Sage offers products like Sage 50cloud and Sage Intacct, focusing on cloud technology, AI, and automation for businesses of all sizes.

2.1.2 Sage Main Business Focus

In the 1990s, Sage grew quickly by buying other companies, expanding globally. In 2017, they launched Sage Business Cloud, which lets businesses manage their finances online.

Today, Sage mainly focuses on large businesses and growing small to medium-sized enterprises (SMEs). Their products, like Sage 50cloud and Sage Intacct, help these organizations with complex accounting tasks.

Sage also emphasizes cloud accounting, allowing businesses to access their financial information from anywhere, which makes it easier to work together. They continue to innovate by exploring AI and automation to simplify accounting processes for businesses of all sizes.

2.1.3 Key Features of Sage

Sage offers a variety of features that cater to the needs of businesses. One key feature is payroll management, which automates the calculation of wages, deductions, and taxes. This helps businesses save time and ensures employees are paid accurately and on time.

Another important feature is inventory management. Sage allows businesses to track stock levels, manage orders, and monitor sales trends. This helps businesses keep their inventory organized and ensures they have the right products on hand.

Also, Sage Compliance: this helps businesses stay up to date with tax laws and regulations, ensuring they meet legal requirements and avoid penalties from governing bodies and regulations.

Additionally, Sage provides financial reporting tools that offer insights into a business’s financial health. These reports help decision-makers analyze performance and plan for the future. Customer relationship management (CRM) features are also available, allowing businesses to manage customer interactions and improve service.

Sage is designed to streamline accounting processes, improve efficiency, and support businesses in various areas of financial management.

2.2 QuickBooks Overview

2.2.1 Background on QuickBooks

QuickBooks is accounting software developed by Intuit, first launched in 1983. It was designed to simplify financial management for small businesses with a user-friendly interface. Over the years, QuickBooks has evolved to include both desktop and cloud-based versions, catering to various accounting needs.

Its popularity in the small business accounting space stems from its comprehensive features, including invoicing, expense tracking, payroll processing, and financial reporting. QuickBooks is easy to use, even for those with little accounting experience.

The software’s flexibility and scalability allow businesses to upgrade as they grow, and it integrates with various third-party applications for added functionality. So between Sage vs QuickBooks: Which Software is Best for Your Business?, Yet we cant come to final verdict but Today, QuickBooks is one of the leading accounting solutions for small businesses, with millions of users worldwide, thanks to its reliability and extensive support resources.

2.2.2 QuickBooks Business Focus

Over the years, QuickBooks has changed a lot and now offers both desktop and cloud-based versions to meet different needs.

Today, QuickBooks mainly focuses on small businesses, freelancers, and growing companies. Its products, like QuickBooks Online and QuickBooks Desktop, provide important features such as invoicing, expense tracking, payroll processing, and financial reporting, which help these users with their everyday accounting tasks.

QuickBooks also emphasizes cloud accounting, allowing businesses to access their financial information from anywhere, which makes it easier to work together. With regular updates and improvements, QuickBooks remains a popular choice for small businesses and freelancers looking to simplify their accounting and support their growth.

2.2.3 Key Features of QuickBooks

QuickBooks has several key features that help different users. One main feature is invoicing, which lets users create and send professional invoices quickly. This is important for small businesses and freelancers to get paid faster.

Expense tracking – QuickBooks helps users keep track of their expenses, categorize them, and attach receipts, which is useful for managing budgets.

Payroll processing is also a key feature. QuickBooks automates payroll calculations and tax deductions, making it easier for small and growing businesses to pay their employees accurately.

Financial reporting tools provide insights into a business’s financial health, allowing users to generate important reports like profit and loss statements. This is essential for growing businesses that need to analyze their performance. For businesses that sell products, inventory management helps track stock levels and manage orders, ensuring they have the right inventory available.

QuickBooks simplifies financial management for small businesses, freelancers, and growing companies, making it easier to stay organized and support growth.

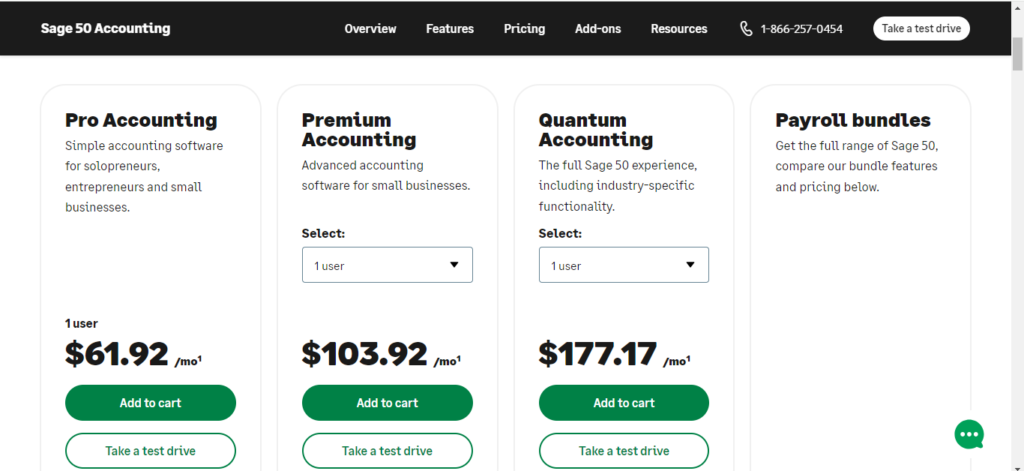

3. Pricing Plan-Sage vs QuickBooks:Which Software is Best for Your Business?

3.1 Sage Pricing Comparison

| Sage Product | Pricing | Key Features | Ideal For |

|---|---|---|---|

| Sage Business Cloud Accounting | Start: $12/month (+VAT) Standard: £23/month (+VAT) | Basic invoicing, bank feeds Multi-currency support (Plus) Project profitability tracking (Plus) | Freelancers, startups, and small businesses seeking cloud-based scalability |

| Sage 50cloud | Xpress: $456/year (+VAT) Partner: $1074/year (+VAT) | VAT management, invoicing Inventory and budget management (Pro) Multi-currency and departmental analysis (Pro) | SMEs needing desktop-based accounting with cloud connectivity and advanced features |

| Sage Intacct | Custom pricing (based on business size) | Real-time financial insights Advanced reporting and audit tracking Multi-entity management and automation | Larger businesses and enterprises requiring advanced financial management and automation |

| Sage Payroll | Starts at $10.87/month per employee (+VAT) | Integrated payroll management Tax and employee payment processing | SMEs looking for a payroll solution integrated with their accounting software |

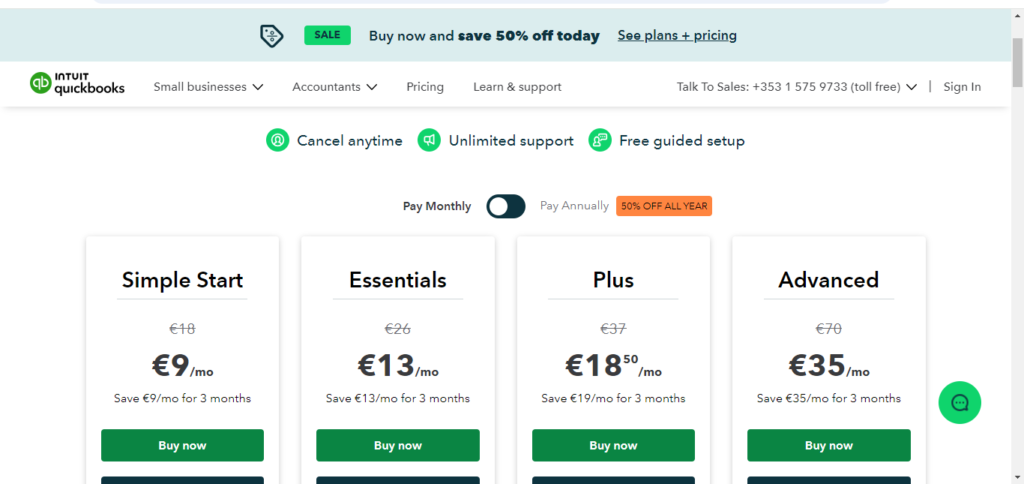

3.2 QuickBooks Pricing Comparison

| QuickBooks Plan | Pricing | Key Features | Ideal For |

|---|---|---|---|

| Self-Employed | $10/month | – Track income and expenses – Mileage tracking – Estimate taxes Organize receipts | Freelancers and independent contractors who need basic accounting and tax tools |

| Simple Start | $9/month | – Invoicing – Sales tax tracking – Bank feeds – Track income/expenses | Small businesses needing basic invoicing and expense tracking features |

| Essentials | $13/month | – Everything in Simple Start – Manage bills and track time – Multi-currency support – 3 user access | Small businesses managing vendor bills and needing multi-user collaboration |

| Plus | $18/month | – Includes all Essentials features – Inventory – tracking – Project profitability Budgeting – 5 user access | Growing businesses managing inventory and projects, requiring budgeting tools |

| Advanced | $35/month | – All features in Plus – Advanced reporting – Custom user permissions – Batch invoicing – Automated workflows – 25 user access | Larger businesses needing advanced financial reporting, automation, and workflow customization |

3.3 Which has the Best Free Plan ?

Neither Sage nor QuickBooks provides a permanent free plan, but both platforms offer a 30-day free trial for any plan and the corresponding number of users. Additionally, each service includes promotional discounts. Sage offers a 70% discount on any plan for the first six months if users commit to a yearly subscription.

Similarly, QuickBooks offers a 50% discount for the first three months, even with monthly payments. However, users who opt for this discounted rate won’t be eligible for the 30-day free trial.

3.4 Which Offers Better Value for Money ?

In terms of value for money, Sage is cost-effective for SMEs, while QuickBooks generally provides a greater return on investment, particularly for businesses looking to automate processes and scale operations efficiently. The advanced features and flexibility of QuickBooks make it a more strategic choice for companies aiming for growth, while Sage’s affordability is beneficial for smaller businesses with less complex accounting needs.

4. User Interface-Sage vs QuickBooks: Which Software is Best for Your Business?

4.1 Sage User Interface

Sage offers a simple and clean dashboard that helps users easily navigate and view their financial data. The layout is designed to make it easy for both new users and experienced professionals to access the information they need. Sage’s dashboard presents important details like expenses, revenues, and reports in one place, so users don’t have to search for critical financial information.

For new users, the system is straightforward for basic tasks, though more advanced features, like managing multiple entities or custom setups, may take some time to learn. Sage’s cloud products, like Sage Intacct, make it easy to access financial data from anywhere, which is great for users who need flexibility. However, accounting professionals will find that the system includes more in-depth tools that are useful for handling complex accounting tasks.

4.2 QuickBooks User interface

QuickBooks is known for offering a highly user-friendly experience, particularly for small business owners and freelancers with little to no accounting background. The interface is clean and intuitive, making it easy to navigate through tasks like invoicing, expense tracking, and generating reports. One of its biggest strengths is the simple setup process, which guides users step-by-step, making it accessible even for those new to accounting software.

However, while QuickBooks Online versions, like Essentials and Plus, are more straightforward, users may encounter a bit of a learning curve when dealing with more advanced features, such as detailed financial reporting or payroll management. For new users, the software includes clear instructions, guides, and tutorials that help simplify these tasks. Additionally, QuickBooks frequently updates its platform with new features, which can require users to stay updated to fully leverage its capabilities.

4.3 Which Platforms Easier to Use?

QuickBooks is generally easier to use for small business owners and non-accountants. Its interface is simple, and tasks like invoicing or tracking expenses are easy to handle without much accounting knowledge. QuickBooks also provides helpful tutorials and guides to assist users.

Sage, while offering advanced features, can be harder for beginners. It’s great for businesses that need more detailed accounting tools but requires a bit more familiarity with accounting concepts, making it less beginner-friendly.

In short, QuickBooks is better for ease of use, while Sage is more suited for experienced users or growing businesses needing advanced tools.

5. Features Comparison-Sage vs QuickBooks: Which Software is Best for Your Business?

5.1 Core Accounting Features

Sage offers a detailed general ledger, strong accounts payable/receivable management, and supports tax management and multi-currency transactions, making it ideal for businesses handling complex financial. Its inventory tracking is perfect for companies managing physical stock.

QuickBooks simplifies accounting with an easy-to-use general ledger, fast invoicing, and efficient expense tracking. It automates sales tax calculations and includes mileage tracking, which is helpful for small businesses and freelancers.

So, Sage suits larger, complex needs, while QuickBooks is designed for simpler, smaller-scale operations.

5.2 Automation and AI

Sage provides advanced automation for billing, reporting, and compliance tracking. These features help businesses reduce manual work by automatically generating bills, preparing financial reports, and ensuring compliance with tax regulations. Sage also integrates AI in certain aspects, like predictive analytics, to assist in forecasting and more complex financial tasks.

While QuickBooks focuses on automating tasks for small businesses. It simplifies routine activities like recurring invoices, where the system automatically sends repeated invoices without manual input. The receipt capture feature allows users to scan and upload receipts directly into the system for easy expense tracking. Bank transaction matching further streamlines operations by automatically categorizing and reconciling transactions with minimal user input.

The above comparison denotes that Sage offers more robust automation for larger businesses with complex needs, while QuickBooks focuses on simplifying everyday tasks for small businesses and freelancers.

5.3 Payroll and Tax Management

Sage integrates payroll into its accounting system, allowing businesses to process employee payments and manage payroll taxes within the platform. It also handles tax filing and helps ensure compliance with local labor laws and tax regulations. Sage’s payroll solution is flexible, making it suitable for businesses with complex payroll structures or multiple locations. Additionally, it provides tools for managing benefits, deductions, and other payroll elements.

QuickBooks, on the other hand, includes built-in payroll processing, making it easy for small businesses to manage employee payments directly from the platform. It automatically calculates taxes, including payroll and sales tax, and even offers automatic filing options for both state and federal taxes. QuickBooks also includes features for tracking employee time, which integrates seamlessly into the payroll system, making it a good fit for businesses with simple to moderate payroll needs.

This means Sage is ideal for businesses needing more complex payroll management and compliance, while QuickBooks simplifies payroll and tax management for smaller businesses with built-in automation.

5.4 Customizations and Reports

Sage excels in advanced reporting, offering a wide array of customizable options. Businesses can tailor their reports and dashboards to fit their specific needs, and it includes templates designed for various industries. This level of customization makes it a good fit for larger organizations or businesses with complex reporting requirements. Sage also allows users to generate in-depth reports on financial performance, compliance, and other key business metrics.

QuickBooks, while simpler, provides robust customizable reports as well. Users can track key performance indicators (KPIs) such as cash flow, profitability, and expenses. Its built-in reporting tools are particularly useful for small businesses that need insights into their financial health. Although it may not offer the same industry-specific templates as Sage, QuickBooks still allows for customization in report generation, including the ability to modify existing templates to suit specific needs.

So, Sage is ideal for businesses seeking in-depth, industry-specific reports and high-level customization, while QuickBooks is perfect for small businesses looking for user-friendly, customizable reports that focus on essential financial metrics.

6. Integration-Sage vs QuickBooks: Which Software is Best for Your Business?

6.1 Sage Integration

Sage has many integrations with other software that help businesses work better. It connects smoothly with Customer Relationship Management (CRM) systems, payment processors, and e-commerce platforms, making it easier to manage finances and operations.

One popular integration is with Microsoft 365. This allows users to link their Sage data with tools like Excel and Outlook, making it easy to analyze data and communicate. Sage also works with Shopify, which is great for online stores. This integration helps businesses keep track of sales, inventory, and customer information all in one place.

When it comes to payment processing, Sage integrates with Stripe, allowing businesses to handle online payments easily. This connection automates invoicing and tracks payments, helping businesses manage their cash flow better. It also reduces the chances of manual errors.

Overall, Sage’s various integrations make it a flexible choice for businesses. By using these connections, companies can improve efficiency, engage customers better, and gain insights into their financial health.

6.2 QuickBooks Integration

QuickBooks is popular for its many integrations with third-party apps, making it easy for businesses to manage their accounting. It works well with payment platforms like PayPal and Square, allowing businesses to accept payments and keep their financial records updated automatically.

QuickBooks also connects with e-commerce platforms like Shopify. This integration helps online stores track sales and inventory directly in QuickBooks, reducing manual work and providing a clearer view of finances.

Additionally, QuickBooks integrates with various Customer Relationship Management (CRM) tools, helping businesses link sales and customer data to their accounting software. This connection improves customer service by providing insights into sales trends and customer interactions.

QuickBooks has a large app ecosystem with many add-ons tailored for different industries. These apps can enhance features like project management, payroll, and inventory management, making QuickBooks a flexible choice for various businesses.

QuickBooks’ strong integration options and extensive app selection help businesses work more efficiently and manage their finances better.

6.3 Which Has Better Integration Capabilities?

When comparing integration capabilities, QuickBooks generally offers more flexibility and options, making it ideal for small and medium-sized enterprises (SMEs), especially in retail and e-commerce. Its compatibility with numerous third-party apps, like Shopify and Square, allows businesses to manage sales, payments, and inventory seamlessly while keeping financial records synchronized. The extensive app ecosystem also means SMEs can find tailored solutions for their specific needs.

Sage, while not as extensive in app options, provides strong integrations that cater well to service-oriented industries. Its connections with essential tools, like Microsoft 365 and Stripe, are beneficial for businesses that focus on professional services and need reliable payment solutions.

I will concludes that QuickBooks is better suited for retail and e-commerce due to its broad integration capabilities, while Sage is a strong choice for service-based industries, focusing on enhancing efficiency and collaboration. The best option depends on the specific needs of the business.

7. Mobile App Experiences-Sage vs QuickBooks: Which Software is Best for Your Business?

7.1 Sage Mobile App

The Sage Mobile App offers a range of features that enable users to manage their accounting tasks on-the-go. In terms of invoicing, users can create and send professional invoices, track payments, and send reminders. The app also allows for expense tracking, enabling users to capture and categorize expenses, attach receipts, and track mileage.

In addition to these features, the Sage Mobile App provides access to financial data, allowing users to view reports and manage accounts from anywhere. The app also offers real-time syncing with Sage accounting software, ensuring that data is always up-to-date. Customizable dashboards and reports are also available, enabling users to tailor the app to their specific needs. Collaboration tools are also included, allowing multiple users to work together seamlessly.

The Sage Mobile App is available on both iOS and Android devices, with a 4.8/5 rating on the App Store and a 4.5/5 rating on the Google Play Store. The app is secure and backed up, protecting user data. Overall, the Sage Mobile App is a powerful tool for businesses looking to manage their accounting tasks on-the-go.

7.2 QuickBooks Mobile App

The QuickBooks Mobile App is a user-friendly accounting solution for businesses on-the-go. Its intuitive interface and features simplify financial management.

The app offers easy receipt capture, automatic mileage tracking, and comprehensive reports. Users can create and send invoices, track expenses, and connect bank accounts for seamless financial management.

Additional features include expense tracking, budgeting, and banking connectivity. The app is available on both iOS and Android devices, with a 4.8/5 rating on the App Store and a 4.5/5 rating on the Google Play Store.

Overall, the QuickBooks Mobile App is an excellent choice for businesses seeking a comprehensive and user-friendly accounting solution on-the-go. Its ease of use and robust features make it an ideal tool for managing finances anywhere, anytime.

7.3 Which Mobile App Perform Better ?

When it comes to providing a seamless mobile experience for small business owners, QuickBooks Mobile App seems to perform better. Its user-friendly interface makes it easy to navigate and use, even for those without extensive accounting experience.

QuickBooks offers a comprehensive range of features, including receipt capture, mileage tracking, invoicing, expense tracking, and banking connectivity. This makes it an ideal tool for small business owners who need to manage their finances on-the-go. Additionally, QuickBooks has higher ratings on both the App Store (4.8/5) and Google Play Store (4.5/5), indicating better user satisfaction.

In contrast, Sage Mobile App, while still a good option, has a slightly more complex interface and fewer features. However, it’s essential to note that Sage is a more comprehensive accounting solution, and its mobile app is designed to complement its desktop version.

Ultimately, the choice between QuickBooks and Sage depends on individual preferences and specific business needs. Both apps have their strengths and weaknesses, and it’s recommended to try out both and use the features you need to see which one works best for you.

8. Customer Support – Sage vs QuickBooks: Which Software is Best for Your Business?

| Feature | Sage | QuickBooks |

|---|---|---|

| Customer Support Channels | – Phone support – Live chat – Email support | – Phone support – Live chat – Email support |

| Availability | Monday to Friday, standard business hours | 24/7 support for higher-tier plans Standard hours for lower-tier plans |

| Onboarding Assistance | Assisted onboarding for all plans | Guided setup for all plans, with in-depth assistance on higher tiers |

| Knowledge Base | Extensive online help center, articles, and guides | Comprehensive help center with articles, tutorials, and videos |

| Community Support | Sage Community forums for peer support | QuickBooks Community forums and user groups |

| Training & Webinars | Free webinars, tutorials, and product demos | Free webinars, tutorials, and on-demand training resources |

| Premium Support Options | Available at extra cost for certain plans | Available for higher-tier plans (Advanced) |

| Learning Resources | Sage University for advanced training and certifications | QuickBooks Certification and QuickBooks Training portal |

| Mobile App Support | Support via mobile app for accounting queries | In-app support through the QuickBooks mobile app |

Both platforms offer strong customer support, but QuickBooks has the advantage of 24/7 support on higher plans and more extensive mobile app assistance, while Sage offers a dedicated Sage University for advanced training.

9. Pros and Cons-Sage vs QuickBooks: Which Software is Best for Your Business?

9.1 Sage pros and Cons

| Pros | Cons |

|---|---|

| Scalability: Suitable for businesses of all sizes, from small to large enterprises | Limited Automation: Lacks full automation for certain processes unless add-ons are purchased |

| Robust Inventory Management: Strong inventory and stock control features, ideal for businesses with complex needs | Complex for Beginners: Interface can be challenging for those new to accounting software |

| Localized Solutions: Tailored to regional tax laws and regulations | Support Limited to Business Hours: Customer support is not available 24/7 |

| Sage University: Offers advanced training and certification programs | Costly Add-Ons: Essential features like Auto Entry require additional payment |

| Affordable Entry-Level Plans: Competitive pricing for small businesses, especially in the UK | Desktop Reliance: Heavily relies on desktop software with cloud integration, limiting fully cloud-based options |

9.2 QuickBooks Pros and Cons

| Pros | Cons |

|---|---|

| Automation: Offers automated features like bank feeds, receipt capture, and tax tracking, reducing manual effort | Higher Cost: More expensive than Sage, especially for accessing advanced features |

| User-Friendly Interface: Intuitive and easy to use, ideal for beginners and small business owners | Limited Features in Entry Plans: Basic plans lack key features like bill management and multi-user access |

| Cloud-Based Accessibility: QuickBooks Online offers fully cloud-based access, allowing accounting management from anywhere | Add-On Costs: Payroll, time tracking, and other advanced features require additional fees |

| Advanced Reporting: Provides customizable and advanced reporting tools, particularly in higher-tier plans like QuickBooks Advanced | Complex for Advanced Users: May lack the depth and customization larger businesses or advanced users need |

| 24/7 Customer Support: Round-the-clock customer support available for higher-tier plans | Mobile App Limitations: The mobile app offers limited functionality compared to the desktop version |

10. Conclusion: Ideal Use Cases

Sage for Medium-Sized Businesses and Industry-Specific Needs:

Sage is an excellent choice for medium-sized businesses and organizations that require robust, scalable accounting solutions. Its comprehensive tools, including inventory management, departmental analysis, and multi-currency support, make it suitable for businesses with more complex needs. Additionally, Sage offers industry-specific solutions, catering to sectors like manufacturing, construction, and nonprofits. This versatility makes it ideal for businesses seeking customized features that can adapt as they grow.

QuickBooks for Small Businesses and Freelancers:

QuickBooks is perfect for small businesses and freelancers needing affordable, easy-to-use accounting tools. Its intuitive interface allows users to quickly manage invoices, track expenses, and automate tax calculations. QuickBooks is particularly useful for service-based businesses and freelancers who require efficient invoicing, simple expense tracking, and real-time financial insights. With its scalable plans, businesses can start small and upgrade to more advanced features as their operations expand.

Now that you have know the best accounting software for your business needs, its time for you to scale up with effective marketing, click here to find the best email marketing tool for your business

Pingback: AI Spreadsheet Automation to Boost Productivity..."Paradigm": - Platform Adviser

Pingback: Deel vs Remote.com: Best Payroll/Hiring Solution for Global Teams