TL DR:

Ultimately, choosing the best payment platform for your business is a function of your business’s goals and customer’s unique needs.

However, to make that decision easier for you, we took a deep dive into the two top payment systems in Nigeria: Paystack and Flutterwave. This is our verdict:

For Local business or startups: Paystack is the recommended platform, it offers simplicity, straightforward pricing structure and faster settlements. On the other hand, Larger and more established business or international companies are better off using using Flutterwave. It provides scalability, flexibility, and strong international support. Likewise, Business with specific needs, with high transaction volumes or custom integrations should lean towards Flutterwave for their advanced features and flexibility to handle complex payment scenarios.

Table of Contents

1. Introduction

Choosing the best payment platform for Nigerian businesses can be challenging. Giving the amount of options that are available and the lack of deep dive information about them.

In this article, we will focus on the two top players namely: Paystack and Flutterwave. We will break down their key differences, features, pricing, user-friendliness, security features, customer service and overall suitability. In the end, we will help you make an informed decision on the best payment platform for your business.

1.1 Overview of the Nigerian Payment Landscape

Nigeria’s payment landscape has seen significant growth and innovation over the past few years. The rapid adoption of digital means of payments in order to meet the needs of businesses and consumers has aided this growth.

The two key players in Nigeria payment system: Paystack and Flutterwave, dominate the online payment solution in Nigeria. Both businesses offer technological solutions for business of various scale to receive payments both locally and internationally.

In 2023, the Nigeria government introduced cashless policy which has aided the digital adoption of online payment solution. Likewise, the increase in smartphone usage has boost digital payment and mobile money services adoption.

The Nigeria payment ecosystem is not perfect. There are several issues around security, infrastructure and fraud plaqued the system. Despite these issues, the future looks bright with continued innovation and expansion from both sides. This provides options to choose the best payment platform for Nigerian businesses.

1.2 Importance of Choosing the Right Payment Platform

With majority of customers now shopping and paying online, having a reliable way to collect payments make a huge difference in your business. Paystack and Flutterwave are two of the leading options, but which one is the best fit for your business?

As a small business owner, understanding the strengths and weaknesses of each platform is essential. Hence, this will allow you to choose the best payment platform for Nigerian businesses. Let’s see which of these two heavyweights is the better choice for Nigerian businesses.

1.3 Introduction to Paystack and Flutterwave

In 2015, two Nigerian entrepreneurs Shola Akinlade and Ezra Olubi with a clear mission. To simplify online payments for businesses across Africa launched Paystack.

In 2020, in a worth over $200 millions. Stripe a global payments leader acquired Paystack. This acquisition strengthened Paystack’s resources and broadened its influence, solidifying its position as one of Africa’s top payment platforms.

Paystack rise to prominence is largely due to its commitment to streamlining payments for businesses of all sizes. The platform offers various payment options, including cards, bank transfers, and mobile money, crucial for Africa’s diverse market.

Over time, Paystack has continuously evolved, introducing new features and expanding its operations into other African countries.

Similarly, in 2016, two Nigerians, Iyinoluwa Aboyeji and Olugbenga Agboola founded Flutterwave. Flutterwave set out to create a platform that connects African businesses to the global market. It quickly became a fin-tech leader, attracting major investments and partnering with companies like PayPal.

Beyond payment processing, Flutterwave offers services such as the Flutterwave Store, enabling small businesses to easily create online shops. This makes it a valuable tool for entrepreneurs seeking to grow their businesses online.

Flutterwave supports businesses across several African countries, including Nigeria, Ghana, Kenya, and South Africa. Flutterwave focuses on cross-border payments and multi-currency options, making it a preferred platform for companies aiming to reach international markets.

2. Company Background

2.1 Paystack

2.1.1 History and Funding

Paystack is a Nigerian Fintech company providing payment processing solutions for businesses, with the headquarters in Lagos. In 2020, Stripe, an Irish-American financial services firm acquired Paystack in a $200 million deal.

Who is the owner of Paystack?

The founders: Shola Akinlade and Ezra Olubi, met at Babcock University. They both had experience in banking and IT before starting the company. In 2018, Paystack expanded its operations to Ghana followed by South Africa in 2021. They entered the Kenyan market in 2023.

In November 2015, Paystack was accepted into the startup accelerator Y-Combinator. It was the first Nigerian company to be accepted into the program.

In 2016, Paystack secured $1.3 million in seed funding from Tencent and other investors. Two years later, it raised $8 million in Series A funding led by Stripe.

In 2020, Stripe acquired Paystack for $200 million to expand its presence in Africa. At the time of the acquisition, Paystack had already established itself as a leading payment platform. It was serving over 60,000 businesses in Nigeria and Ghana for both online and offline transactions.

2.1.2 Mission and Vision

What problem does Paystack solve?

Paystack core Mission and Vision is dedicated to transforming Africa’s payment landscape, enabling businesses to effortlessly accept payments. This, in turn, drives economic growth and development across the continent.

Futhermore, with secure, and intuitive payment solution, Paystack empowers businesses of all sizes to flourish in the digital economy. Through its unwavering commitment to innovation and customer success, Paystack has emerged as a pioneer in Africa’s Fintech sector. It promotes financial inclusion; creating new opportunities for businesses and individuals to thrive. Since its establishment, Paystack has been launching new features to be the best payment platform for the Nigerian business

Powering a new generation of businesses in Africa

Paystack is a technology company solving payments problems for ambitious businesses. Our mission is to help businesses in Africa become profitable, envied, and loved.”

2.1.3 Market Presence and Growth

Which countries is paystack available?

Paystack, a leading Nigerian Fintech company, has rapidly expanded its operations across Africa. Initially launched in Nigeria in 2015, the company now operates in Ghana, South Africa, and Kenya.

Its services focus on enabling businesses to accept payments easily online and offline. Likewise, it provides integration with global platforms like Shopify and Apple Pay among others.

Paystack growth has been driven by its ability to cater to the local needs of businesses while offering modern, user-friendly payment solutions. Nigeria and Ghana represent its most successful markets, with high adoption by e-commerce businesses. Recently, Paystack has also started private beta testing in Ivory Coast, Egypt, and Rwanda, signaling potential future expansions.

Despite these positive strides, Paystack has scaled back its operations outside Africa. Notably the laying off of staff in Europe and the UAE. This move reflects a shift towards prioritizing growth and localization within its core African markets. Additionally, there are no significant reports of any country outright banning Paystack’s services.

With Stripe’s $200 million acquisition of Paystack in 2020, the company’s reach and potential for future growth have further increased. Paystack is positioned as a major player in Africa’s digital payments landscape

2.2 Flutterwave

2.2.1 Founding and History

Who is the owner of Flutterwave?

In 2016, Iyinoluwa Aboyeji, Olugbenga Agboola, and Adeleke Adekoya founded Flutterwave. Flutterwave is based in San Francisco and operates in the U.S., Canada, Nigeria, and 29 other African countries. In 2021, it raised $170 million in Series C funding, reaching a valuation of over $1 billion, becoming a unicorn. In 2022, it secured $250 million in Series D, pushing its value to over $3 billion.

Flutterwave launched Send App in 2021, a remittance service for sending money across borders with Wizkid as its global ambassador. By 2024, Flutterwave announced plans for an IPO. It partnered with Nigeria’s EFCC on a CyberCrime Research Center, and expanded its payment services to Ghana. This move marks its 34th African country license.

2.2.2 Mission and Vision

What problem does Flutterwave solve?

Flutterwave’s mission is to drive a new era of prosperity throughout Africa. By facilitating global digital payments in a region that has historically been excluded from the digital economy. Indeed, the company is building the essential infrastructure to support Africa’s economic development in the 21st century.

Endless possibilities for all

Unlocking boundless payment opportunities for enterprises, individuals, small businesses, emerging markets, and startups alike.

2.2.3 Market Presence and Growth

Which countries is Flutterwave available?

Flutterwave, founded in 2016, has experienced rapid growth, establishing itself as one of Africa’s leading Fintech companies. In addition to its business in Nigeria, It operates in over 30 African countries. Chiefly facilitating payments across borders e-commerce solutions, and remittance services.

The company’s success has led to partnerships with major global platforms like PayPal and Visa. As a result, allowing it to expand its reach beyond the African continent.

Despite its success, Flutterwave has faced challenges in some markets. For instance In Kenya, the company was involved in legal disputes over regulatory issues, which led to a temporary freeze of its assets by Kenyan authorities. However, in early 2023, these charges were cleared, allowing Flutterwave to resume operations in the country, where it now competes with the dominant player, M-Pesa.

Flutterwave has also made strides in countries like Rwanda and Ghana, where it secured key licenses to expand its services. As it prepares for an Initial Public Offering (IPO), Flutterwave is focusing on strengthening its governance and operational structures, which has helped restore investor confidence after facing internal challenges.

Nigeria and other parts of West Africa, remains the strongest markets are where Flutterwave services are widely adopted by businesses for online payments. Flutterwave continues to expand aggressively across Africa, while also eyeing growth opportunities in North America and other international markets.

3. Features Comparison Between Paystack and Flutterwave

3.1 Payment Processing

3.1.1 Supported Payment Methods

Paystack:

- Cards (Visa, Mastercard, Verve) – Accepts major credit and debit cards.

- Bank Transfers – Payments via direct bank transfers.

- USSD Payments – For users without internet access.

- Mobile Money – Available in Ghana and other regions where mobile money is prevalent.

- QR Codes – Payments by scanning QR codes.

- Apple Pay – Supported in select regions

Flutterwave:

- Cards (Visa, Mastercard, Verve, American Express) – Accepts a broader range of cards.

- Bank Transfers – Supported for users in various countries.

- Mobile Money – Available in Kenya, Ghana, Uganda, and other African countries.

- USSD Payments – Accessible for users across multiple regions.

- Barter by Flutterwave – A wallet option provided by Flutterwave for easier transactions.

- M-Pesa – Supported in East Africa.

3.1.2 Transaction Speed

Paystack:

Paystack claims its transactions are completed within seconds. Most users report quick processing times. For example, a user on Capterra noted that their transactions were “successfully and swiftly” completed. However, there are occasional complaints about slower fund settlements, particularly with same-day transfers.

Flutterwave:

Flutterwave also emphasizes fast transactions, but user experiences show a mix. While many customers praise the speed of international transactions, others have reported delays with fund settlements in certain regions.

One user mentioned that while payments go through quickly, getting the funds to reflect in their accounts can take longer, depending on the banking partner involved.

3.2 Integration Capabilities between Paystack and Flutterwave

3.2.1 API and SDK Support

Both Paystack and Flutterwave offer robust API and SDK support, making them suitable for developers to integrate with a variety of applications.

Paystack:

Overall, Paystack provides a well-documented API that supports several programming languages, including JavaScript, Python, PHP, and Ruby. It allows businesses to customize payment flows, handle recurring billing, and manage transactions with ease.

Additionally, Paystack provides SDK for mobile platforms like Android and iOS, which simplify the integration for mobile apps. Additionally, their API documentation is highly regarded for its clarity and developer-friendly approach.

Flutterwave:

Flutterwave also offers a comprehensive API that supports multiple programming languages such as JavaScript, Python, PHP, and Java. They provide SDK for Android and iOS, allowing mobile developers to easily embed payment functionality into their apps. Flutterwave’s API is flexible, offering businesses the ability to manage transactions, set up automated billing, and access detailed analytics.

3.2.2 E-commerce Platform Integrations

Both platforms offer extensive integration options with popular e-commerce systems.

Paystack:

Paystack integrates with platforms like Shopify, WooCommerce, Magento, and WordPress. It offers plugins for these platforms that make it easy for merchants to accept payments without needing extensive coding knowledge. For instance, Paystack’s WooCommerce plugin allows for seamless integration with WordPress, enabling Nigerian and African merchants to accept payments online effortlessly.

Flutterwave:

Flutterwave integrates with a wide range of e-commerce platforms, including Shopify, WooCommerce, Wix, and BigCommerce. They also support custom integrations via their API. The platform’s strong partnership with PayPal makes it an attractive option for merchants looking to accept international payments on their e-commerce websites.

3.2.3 Mobile App Integrations

Both Paystack and Flutterwave provide options for mobile app integration, allowing developers to add payment capabilities to native apps.

Paystack

Paystack’s SDK for Android and iOS make it simple for developers to integrate payment functionality into their mobile apps. It supports mobile-friendly payment methods like USSD, mobile money, and bank transfers, making it ideal for apps targeting African markets.

Flutterwave:

Flutterwave offers similar mobile app integration capabilities, with SDK for Android and iOS. The platform is particularly well-suited for apps that need to support mobile money and card payments across multiple African countries. Flutterwave’s mobile SDK allow for smooth handling of multiple currencies, which is vital for businesses operating across borders.

3.3 User Interface and Experience Between Paystack and Flutterwave

3.3.1 Dashboard and Analytics

After testing both the platforms and based on user’s review I personally interviewed whom were asked to be kept anonymous. Both Paystack and Flutterwave offer comprehensive dashboards with real-time analytics, but users have differing opinions on their ease of use.

Paystack’s dashboard is frequently praised for its simplicity and well-structured design, offering users detailed reports, transaction histories, and customer insights. Many users find it intuitive and user-friendly, particularly for small businesses that need straightforward data tracking and reconciliation.

Flutterwave’s dashboard is similarly feature-rich. However, it is seen as having a slightly steeper learning curve, due to the broader range of services offered. It provides advanced features like global transaction tracking, business loans and virtual card management. These are particularly useful useful for large scale businesses.

Hence, users appreciate these functionalities but note that it requires more navigation compared to Paystack’s clean and minimalist layout.

3.3.2 Ease of Use for Merchants

In terms of ease of use, merchants generally find Paystack simpler for getting started, especially for local payments. The platform is praised for its straightforward integration and low learning curve. Which allows businesses to start accepting payments with minimal friction. Merchants often highlight how Paystack’s design caters to both technical and non-technical users, making it a popular choice among SMEs.

On the other hand, Flutterwave is commended for its versatility. As it supports a wider range of payment methods, currencies, and international transactions. It’s particularly favored by businesses looking to expand across borders.

However, some users mentioned that the onboarding process is a bit more involved compared to Paystack, especially if using the advanced features. Flutterwave’s wider range of functionalities makes it suitable for larger enterprises with diverse operational needs.

3.4 Additional Services: Paystack vs Flutterwave

3.4.1 Invoicing and Billing

Paystack provides a comprehensive invoicing service where businesses can send invoice to customers directly from the dashboard. It supports automated invoicing, ensuring that recurring invoices can be scheduled. For instance, merchants can set up automated invoices for recurring billing like subscription. This simplify the process for businesses managing multiple clients. These invoices also integrate with Paystack’s payment pages, allowing customers to settle their bills easily online.

Flutterwave also offers invoicing and billing services. It enables businesses to generate professional invoices, track payments, and manage customer information in one place. Flutterwave invoices can be customized and sent out to customers globally, supporting different currencies and payment methods. This is particularly useful for businesses with international clientele, as they can handle invoicing across borders.

3.4.2 Subscription Management

Paystack’s subscription management allows businesses to set up recurring payments, customers only input their card details once for future charges. The subscription feature is flexible, offering varying payment intervals such as daily, weekly, or monthly, depending on the business plan. Additionally, Paystack provides merchants with tools to manage and monitor active subscriptions, including filtering by subscription status and plan details. This feature has been particularly useful for businesses with membership models or those offering regular services.

Flutterwave’s subscription management tool is part of its “Recurring Billing” feature. It works similarly, allowing businesses to collect recurring payments from customers without requiring them to re-enter their payment information. However, Flutterwave’s subscription feature stands out by allowing businesses to handle subscriptions not just locally but also for international customers. It leverages its existing cross-border payment infrastructure. This is beneficial for companies that operate across different countries and need a seamless system for managing global subscriptions.

3.4.3 Virtual and Physical Cards

Paystack does not currently issue virtual debit cards for its users. Instead, the platform focuses on providing payment processing services that support various payment methods. These include debit and credit cards issued by MasterCard, Visa, and Verve.

Paystack introduced virtual accounts, which allow businesses to receive bank transfers quickly, in as little as eight seconds. While these features enhance payment processing capabilities. A dedicated virtual debit card service is not part of their offerings at this time.

Flutterwave goes a step further by offering both virtual and physical cards. The virtual cards can be issued instantly via Flutterwave’s “Barter” platform, and they are widely accepted across international merchants.

Flutterwave’s global reach means that these cards can be used across a wide range of international platforms and locations. Subsequently making it ideal for businesses and individuals who need to manage payments across borders.

In summary, both Paystack and Flutterwave offer invoicing, subscription management and virtual cards. However, Flutterwave’s physical card offering and strong international focus give it an edge in handling global business needs over Paystack. Thereby, some businesses regards Flutterwave as the best payment platform for Nigerian businesses.

4. Pricing Structure

4.1 Paystack Pricing

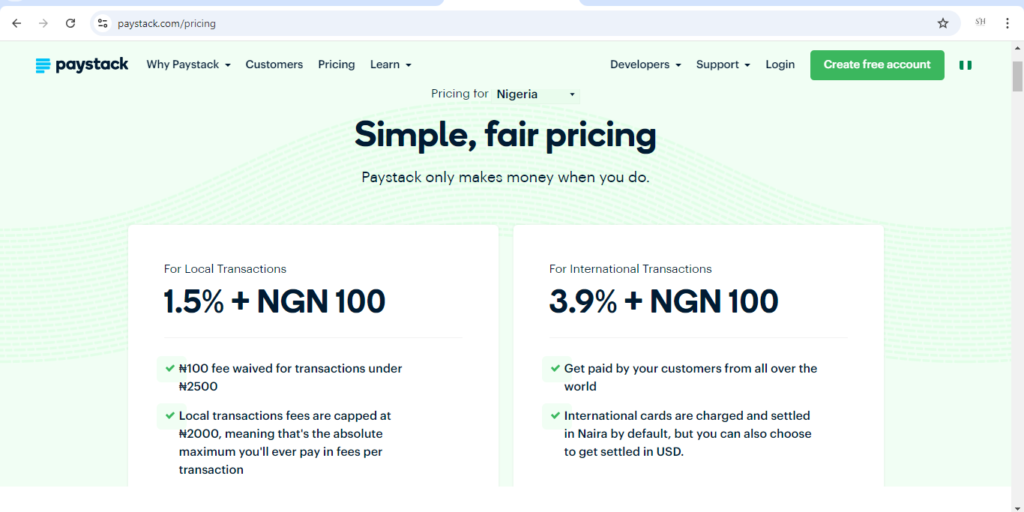

How much does paystack charge?

For domestic transactions, Paystack applies a fee of 1.5% along with a charge of NGN 100. However, for transactions amounting to less than NGN 2,500, the NGN 100 fee is not applied. One of the standout aspects of Paystack’s pricing is transaction fee is limited to a maximum of NGN 2,000. This ensure that merchants will never pay more than this amount for any transaction.

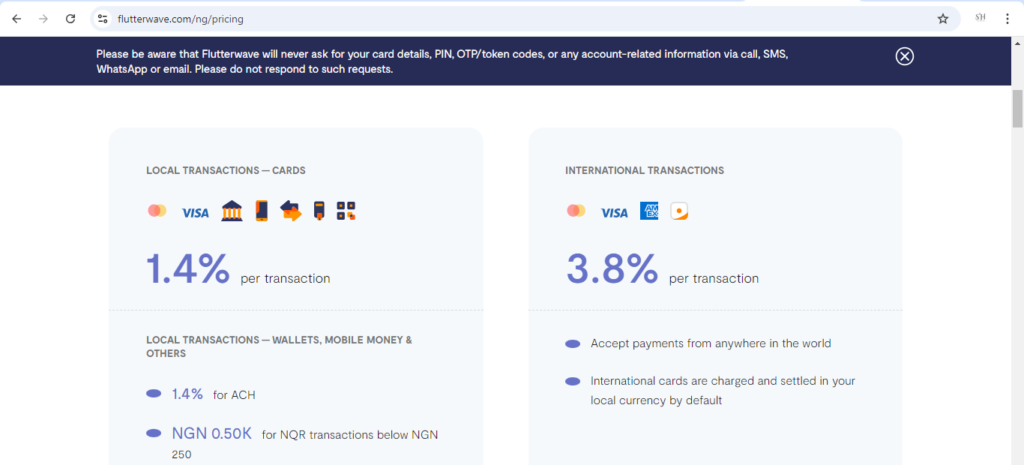

How much does Flutterwave charge?

In contrast, Flutterwave applies a processing fee of 1.4% for local transactions. Similar to Paystack, Flutterwave caps its processing fees at NGN 2,000. But this does not include an additional NGN 100 charge. This pricing structure provides an alternative for businesses looking to manage transaction costs

Which is cheaper Flutterwave or Paystack?

Both Paystack and Flutterwave impose a processing fee of 3.9% and 3.8%, respectively, for international transactions. In addition to these, Paystack applies an extra charge of NGN 100, while Flutterwave does not include any additional fees. This means that while their percentage rates are slightly different, both platforms charges nearly the same amount per transaction.

4.1.2 Setup and Monthly Fees

Is Paystack and Flutterwave free to use?

Both platforms are free to set up without any additional onboarding fee. You can create an account on both platforms and set it up to receive payments completely free. They only charges fees per transaction on transfers and payments you receive.

4.1.3 Additional Costs

There are no additional costs relating to the usage of both platforms

4.2 Cost Comparison Table

| Criteria | Paystack | Flutterwave |

| In term of Best for Different Business Sizes | Best suited for small to medium-sized businesses due to its competitive local transaction fees and features that cater well to startups. Paystack is used by over 60,000 businesses, offering scalability as businesses grow. | Similar to Paystack, Flutterwave is optimal for businesses of various sizes, but its broader reach across Africa and additional features (like business loans) make it a more attractive option for larger, expanding businesses. |

| In term of Hidden Costs and Considerations | Paystack charges 1.5% + NGN 100 per local transaction, but the NGN 100 fee is waived for transactions below NGN 2,500. The fee is capped at NGN 2,000 for larger transactions. There are no hidden costs, but there could be settlement delays at times for merchants. | Flutterwave charges a lower rate of 1.4% per local transaction, and like Paystack, fees are capped at NGN 2,000. There are no extra fees for transactions, but some users have reported issues with Flutterwave’s virtual cards feature, which is currently suspended. |

5. Security and Compliance

5.1 Paystack and Flutterwave Security Features

| Security features | Paystack | Flutterwave |

|---|---|---|

| Data encryption | Paystack uses 2048-bit RSA encryption and stores sensitive cardholder data on AWS servers using AES-256 encryption for data-at-rest. HTTPS and HSTS are used to ensure secure connections and communication across all services | Flutterwave employs advanced encryption methods, ensuring data is encrypted at every stage of processing, including both data-at-rest and in transit, ensuring maximum security |

| Fraud Detection | Paystack has integrated a robust fraud detection system that monitors transactions for unusual patterns, flagging suspicious activities. It also offers real-time transaction monitoring to businesses | Flutterwave has a specialized fraud prevention system, utilizing advanced machine learning algorithms to identify potential fraudulent transactions. This system provides real-time transaction scrutiny to prevent fraud |

| Compliance with Regulation | Paystack complies with PCI DSS Level 1 certification, the highest certification in payment processing. Additionally, it adheres to ISO 27001, ISO 27701, and other international standards such as the Nigerian Data Protection Regulation (NDPR) and relevant data protection laws in the regions it operates | Flutterwave is PCI DSS Level 1 compliant, ISO 27001 certified, and adheres to data protection regulations in multiple regions, including Nigeria’s NDPR. This ensures compliance with global and regional regulations |

Is Flutterwave and Paystack approved by CBN?

Both paystack and Flutterwave are licensed by the Central Bank of Nigeria (CBN). There are reports that paystack has acquire a switching and processing licence from CBN in April 2022.

In August 2024, Flutterwave also anounced they have received the Enhanced Payments Service Provider License.

Flutterwave also holds license as an International Money Transfer Operator license for inbound remittances, Payment System Service Providers (PSSP) Commercial License, Correspondent Banking Relationship License, Switching & Processing License, Settlement Bank License, and Microfinance Bank License

5.2 Comparative Analysis of Security Measures

As a Financial Technology (Fintech) company, both platforms regards security as critical. They provides high levels of data encryption, fraud detection, and regulatory compliance, offering peace of mind to merchants and customers alike.

While their security frameworks are similar, Paystack’s strict encryption architecture and the separation of decryption keys add an additional layer of data security.

On the other hand, Flutterwave’s sophisticated fraud detection algorithms and partnerships for fraud prevention give it an edge in identifying and stopping fraudulent transactions in real-time

6.1 Customer Support and Service

| Customer service | Paystack | Flutterwave |

|---|---|---|

| Support channels (Email, Phone, Livechat) | Email support, with phone and live chat for select users. There is also a help center with FAQs. | Offers email, phone, and live chat support, alongside an extensive help center for self-service. |

| Response Time and Availability | Response times vary but are typically reported as moderate to slow for more complex inquiries, especially on email. | Faster response times, especially through live chat. Many users note that email support can sometimes be slower, but phone support is more efficient. |

| Support Technical Issues | Paystack offers developer support via API documentation, with some technical assistance available via email. Users have noted that technical issues are sometimes resolved slower than expected. | Flutterwave provides extensive API documentation for developers, and technical support is usually available via live chat or email. Some users report quicker resolutions to urgent technical issues compared to Paystack. |

The general consensus is that both platforms have solid support infrastructures. However, Flutterwave tends to offer faster responses for technical queries, especially through live chat

6.2 User Reviews and Satisfaction: Paystack vs. Flutterwave

Paystack:

Paystack has garnered positive feedback from users for its ease of integration, quick transaction processing, and its efficiency in handling payments.

Small to medium-sized businesses especially appreciate Paystack’s seamless API integration and user-friendly interface. As it makes it easy for merchants to accept payments online. A reviewer on Capterra mentioned that Paystack helped their business manage payments smoothly, praising the platform’s overall reliability. However, there are occasional complaints, mostly revolving around settlement delays and customer service response times. Some users found it frustrating when funds weren’t transferred to their accounts promptly, especially with same-day settlement services.

Despite these issues, most users seem satisfied with Paystack’s reliability in processing payments, particularly for businesses that rely heavily on the platform for day-to-day transactions.

Flutterwave:

Flutterwave, often favored by businesses operating across Africa, has received praise for its wide range of payment options. It supports several mobile payment systems like MTN Mobile Money, Orange Money, and credit cards.

These makes it a valuable tool for businesses that need to operate across multiple African countries. A user review on GetApp mentioned the ease of setup and the platform’s wide integration with African payment methods as a major advantage.

On the flip side, users have raised concerns about failed transactions. Many reviewers, especially on Capterra, noted that transactions sometimes fail due to technical issues, which can be frustrating.

Another common issue reported was that Flutterwave’s customer support, while improving, remains a weak point. Customers claimed there is long wait times for resolving critical issues. A user mentioned that while the platform itself was efficient, customer support often failed to address urgent requests.

In summary, users tend to favor Paystack for its simplicity and fast processing times. While Flutterwave is recognized for its versatility in handling payments across African countries.

Failed transactions and inconsistent customer support has cast a negative light on Flutterwave. Similarly there are complains of delays in Paystack settlement timelines even though they enjoy a more streamlined interface.

Part A: Wrap up

What is the best payment gateway in Nigeria?

As we conclude this first part of our deep dive into Paystack and Flutterwave, we’ve examined their histories, features, pricing models, additional services, security measures, and customer support.

Both platforms have emerged as leaders in the African payment landscape. They offer robust solutions to businesses looking to streamline their transactions. However, they each come with unique advantages and challenges.

Paystack is often favor for its intuitive interface, solid security measures, and ease of use. It stands as the go-to choice for small to medium-sized enterprises.

On the other hand, Flutterwave shines with its broad range of payment options and integrations. It is useful for businesses that operate across multiple African countries. Indeed there are concerns with transaction reliability and customer support.

That said, this isn’t the full picture on the comprehensive report on the best payment platform for Nigerian businesses between Paystack and Flutterwave.

In Part B of this comparison, we will explore the platforms’ performance, reliability, ease of integration, setup experiences, and dive into real-world case studies. Likewise, we will analyze the pros and cons, giving you the insights needed to make an informed decision about which payment gateway is best suited for your business needs.

Pingback: ClickUp vs Monday.com Comparison : Which PM Tool is the Best ?

Pingback: The best email marketing tool for small business