Table of Contents

1. Introduction

Freelancers often struggle to secure funding. Unlike traditional businesses with steady cash flow, freelancers face unpredictable income streams that can make it harder to qualify for loans. This is where Lendio business loans step in as a game-changer.

Lendio is a versatile platform that connects freelancers and small business owners with a network of over 75 lenders, offering a range of loan options tailored to diverse financial needs. Whether you’re looking to cover a cash flow gap, finance new equipment, or fund a business expansion, Lendio business loans provide access to multiple lending options all in one place.

In this blog post, we’ll explore how Lendio simplifies the loan application process and why it might be the perfect funding solution for freelancers.

2. What is Lendio?

Lendio is a business loan marketplace designed to simplify the lending process for freelancers and small business owners. Instead of applying to multiple lenders separately, you can complete a single application and get matched with various loan options tailored to your financial needs. This streamlined approach saves time and increases your chances of securing the right funding.

For freelancers, finding reliable funding can be tough. Traditional banks often require extensive paperwork and high credit scores, making it difficult for those with irregular income to qualify for loans. That’s where Lendio business loans make a difference. The platform offers a more accessible way for freelancers to connect with lenders, compare loan offers, and choose the best financing option without the hassle of jumping through multiple hoops.

Through Lendio business loans, freelancers can access several types of funding. These include SBA loans for long-term, low-interest financing, lines of credit for ongoing cash flow needs, and term loans for one-time expenses. Additionally, Lendio also provides invoice financing to bridge gaps while waiting for client payments, merchant cash advances for fast capital based on future sales, and equipment financing for purchasing business assets without upfront costs.

3. How Lendio Works: A Step-by-Step Guide

Getting a business loan doesn’t have to be complicated, especially when using Lendio business loans. Here’s how it works in four simple steps:

Step 1: Create a Profile

Start by setting up a profile on Lendio’s platform. You’ll need to provide basic information about your business, including revenue, credit score, and financial details. This initial step helps Lendio assess your funding needs and match you with the right loan options.

Step 2: Loan Matching

Once your profile is complete, Lendio searches its network of lenders to connect you with loan offers that fit your financial profile. Whether you’re looking for an SBA loan, a line of credit, or equipment financing, the platform does the legwork of finding suitable options.

Step 3: Compare Loan Offers

Next, you’ll receive a list of loan offers to compare. Take a look at interest rates, repayment terms, and fees to find the best deal for your business. This side-by-side comparison helps you make an informed decision without the hassle of applying to multiple lenders.

Step 4: Choose and Apply

Once you’ve picked the best loan, it’s time to apply. Submit the required documents, such as bank statements and tax returns, directly through the platform. If approved, you can receive funding in 24 hours to few days depends on the lender.This makes Lendio business loans a quick and easy solution for freelancers/small business in need of financial support.

4. Types of Loans Available on Lendio

SBA Loans

Backed by the government, SBA loans offer low interest rates and extended repayment terms. They’re ideal for freelancers needing significant funding for business expansion or long-term investments.

Lines of Credit

For freelancers with unpredictable cash flow, lines of credit provide ongoing access to funds. Borrow only what you need and pay interest only on the amount used, making it a flexible option for managing expenses.

Term Loans

Term loans are lump-sum loans repaid over a set period. They’re best for financing specific projects, purchasing equipment, or covering large one-time expenses.

Invoice Financing

Waiting for client payments? Invoice financing lets you borrow against unpaid invoices, giving you immediate cash flow without waiting for clients to settle their bills.

5. Benefits of Using Lendio for Freelancers

| Benefit | Description |

|---|---|

| Multiple Lender Options | Access a wide range of lenders through Lendio business loans, allowing freelancers to compare and choose the best loan terms for their needs. |

| Simplicity | The Lendio platform simplifies the loan application process, offering a user-friendly interface and quick approvals. |

| Tailored Loan Solutions | Lendio business loans provide customized funding options based on your unique financial profile, ensuring you get the right fit. |

| Faster Access to Capital | Receive funds faster than traditional banks, making it easier to cover urgent expenses or capitalize on new opportunities. |

6. Why Freelancers/Small Businesses Should Consider Lendio Over Traditional Banks

Traditional banks often have strict loan requirements, making it tough for freelancers to secure funding. Lendio business loans simplify the process with quicker approvals and more flexible terms. Instead of lengthy paperwork and rigid credit checks, Lendio connects freelancers with lenders willing to work with varying financial profiles. Whether it’s a small line of credit or a term loan for big expenses, Lendio business loans provide accessible funding options tailored to self-employed individuals.

Unlike traditional banks that demand collateral and perfect credit, Lendio business loans offer flexible funding options tailored to freelancers. Whether it’s a line of credit to manage cash flow or a term loan for equipment, Lendio connects you with lenders who understand the ups and downs of freelance income.

Plus, they’re more inclusive, working with borrowers who may not meet strict bank criteria — even those with less-than-perfect credit.

7. Lendio Success Stories

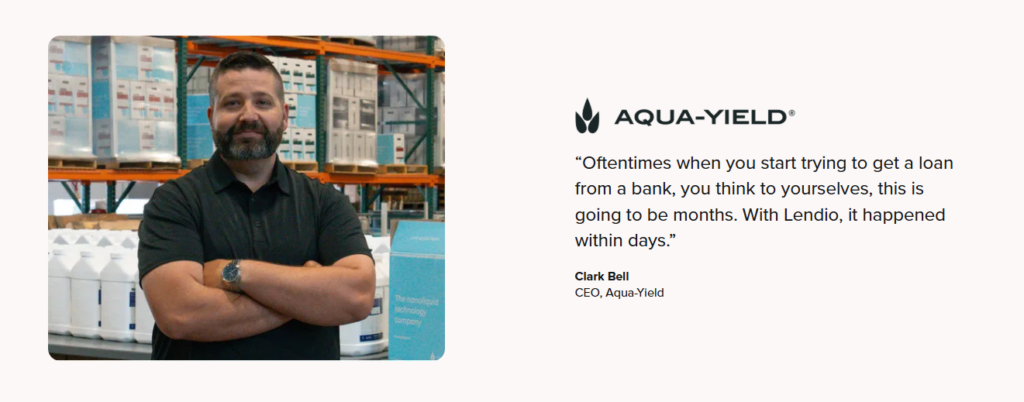

Every thriving business has a story of determination and grit. For freelancers, getting the right funding can make all the difference. Lendio has connected many independent workers with the financing they need to grow and succeed. Let’s explore some real-life stories of how Lendio business loans have made an impact.

Read the complete stories here

Below is another great review from Clark Bell , The CEO of Aqua-yield

These stories show how Lendio business loans can be a game changer for freelancers. Though there are numerous verified reviews on truspilot which you can see here. Ready to level up? Check out Lendio’s loan options and start your journey.

8. Conclusion

Freelancers often face a tough time navigating the world of business financing. That’s where Lendio business loans step in as a game-changer. Instead of dealing with the lengthy, complicated processes of traditional banks, Lendio simplifies everything — from applying for a loan to finding the best rates. Whether you need funds to grow your business, manage cash flow, or handle unexpected expenses, Lendio connects you with the right lenders and loan options, from SBA loans to invoice financing. It’s all about making access to capital easier and faster for self-employed individuals.

Ready to take your freelance business to the next level? Visit Lendio’s website to start your loan search today. Explore multiple funding options, compare offers, and find the best loan terms that suit your financial goals. Don’t let cash flow challenges hold you back — let Lendio business loans provide the financial support you need to grow and thrive.

If you like this article then you should check out these related posts:

- FreshBooks vs Wave: Which Invoicing Software is Best for Freelancers — Discover the best invoicing tool to manage your finances efficiently.

- Vibe Coding: The Future of Software Development — Stay ahead in the tech world with this new approach to coding.

- HubSpot vs Zoho: Which CRM Is Better for Startups? — Compare two powerful CRM platforms to find the right one for your growing business.

- Duolingo AI vs Babbel: Which Offers a Better AI-Driven Language Learning Experience? — Learn a new language effectively with the right AI-powered app.

- Writesonic vs Copy.ai: Best AI Tool for Copywriting and Ad Creation — Boost your marketing efforts with top AI tools for compelling content.