By Abiola Gbolahan

Edited By Fredrick Oladipupo

Table of Contents

1. Introduction

Freelancers are no strangers to tax season stress. Unlike salaried employees, they’re responsible for handling self-employment taxes, tracking quarterly estimates, and meticulously recording every potential write-off. It’s a juggling act that often leads to overpaying or scrambling at the last minute to gather receipts and expenses.

Many freelancers either miss out on valuable deductions or end up paying more than they should simply because they don’t have the right tools to manage their taxes effectively. That’s where Keeper Tax comes in.

Designed specifically for freelancers and gig workers, Keeper Tax takes the hassle out of tax season. It not only simplifies expense tracking but also ensures you never miss a single deduction and potentially saving you hundreds, if not thousands of dollars. Want to keep more of what you earn? Let’s dive into how Keeper Tax is making it easier than ever for freelancers to stay on top of their taxes.

2. Why Freelancers Need Specialized Tax Tools

Freelancers operate under a completely different tax structure than salaried employees. Instead of receiving a W-2 and having taxes automatically deducted, they’re responsible for managing self-employment taxes, tracking quarterly estimates, and accounting for every potential deduction. This is where Keeper Tax for freelancers can make a world of difference.

Unlike traditional employees, freelancers need to stay on top of expenses like home office costs, internet bills, and client meeting expenses. Missing even a single deduction can mean losing out on significant savings. And since freelancers pay estimated taxes four times a year, keeping accurate records is vital to avoid overpaying or underestimating what they owe.

With Keeper Tax for freelancers, expense tracking becomes a daily habit rather than a last-minute scramble. By identifying deductible expenses in real time, it helps freelancers keep more of their hard-earned money without the stress of manual tracking.

3. Quick Overview of Keeper Tax

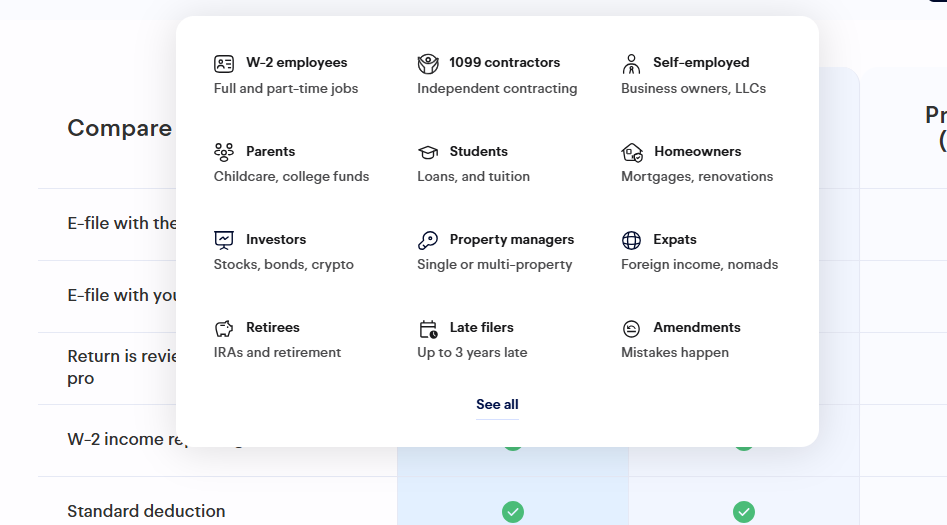

Imagine having a tax assistant right in your pocket and that’s essentially what Keeper Tax offers. It’s a mobile-first tool designed specifically for freelancers, gig workers, creators, and contractors who want to keep their tax game strong without the constant headache of manual tracking. visit official website

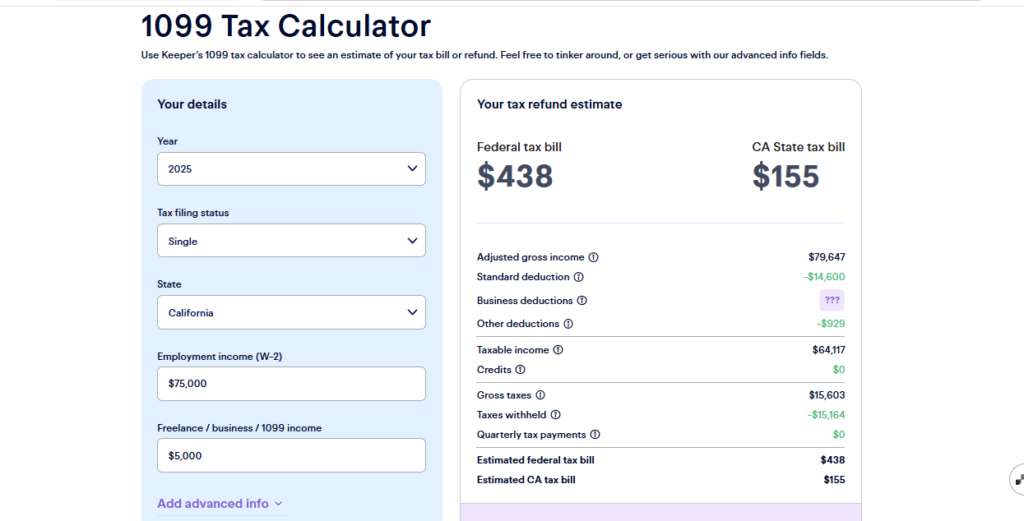

So, how does it work? Keeper Tax connects directly to your bank account and scans your transactions daily, automatically identifying potential deductible expenses. Whether it’s a coffee shop meeting with a client, a new laptop for work, or your monthly internet bill, Keeper Tax flags these expenses and categorizes them as write-offs, so you don’t miss out on valuable deductions.

And when tax season rolls around, Keeper Tax doesn’t just stop at tracking — it also helps you file your taxes, making the entire process smoother and less stressful. Instead of scrambling to gather receipts and calculate expenses, everything is already organized and ready to go.

4. Key Features Freelancers Will Love

| Feature | What It Does | Why It’s Useful for Freelancers |

|---|---|---|

| Automatic Deduction Finder | Scans expenses daily to identify potential write-offs. | Saves time and ensures no deduction is missed. |

| Quarterly Tax Estimates and Reminders | Calculates estimated tax payments and sends reminders. | Helps avoid underpayment penalties and surprises. |

| Tax Filing Built-In | Option to file taxes directly through Keeper Tax, with CPA review available. | Simplifies the tax filing process and reduces errors. |

| Audit Protection | Provides support in case of IRS audits. | Peace of mind knowing someone has your back. |

| Human Bookkeeper Support | Real professionals review your deductions for added accuracy. | Ensures you’re maximizing deductions while staying compliant. |

5. Pricing Breakdown

Keeper Tax offers flexible pricing plans tailored for freelancers, making it a cost-effective choice for tax management compared to traditional CPAs. Here’s the breakdown:

| Plan | Price | Includes |

|---|---|---|

| Just Filing | $99 | E-file with IRS and State (up to 2), W-2 income reporting, standard deduction, tax pro review and signature etc |

| Filing + Deductions | $199 | All features in the Just Filing plan plus deduction tracking, itemized deductions, and receipt storage. |

| Premium | $399 | All features in Filing + Deductions plan plus manual deduction splitting, deduction prediction rules, and quarterly tax payment support. |

Compared to hiring a traditional CPA, which can easily cost $800 or more, Keeper Tax provides substantial savings while ensuring freelancers get the most out of their deductions. This is why many freelancers are choosing Keeper Tax to streamline their tax process and keep more of what they earn.

6. Real-Life Scenarios

Let me tell you about a few people I know who’ve completely transformed their freelance finances with Keeper Tax. but first watch the video below

So, there’s Tolu, a freelance graphic designer based in Lagos. Tolu used to manually track her expenses, jotting down every coffee shop meeting and software subscription in a notebook. It was a mess. Then she started using Keeper Tax. The app flagged dozens of hidden deductions she’d missed, like her home office setup, design tools, even part of her internet bill. By the end of the year, Tolu saved over $600 in taxes she would have otherwise overpaid.

Then there’s John, an Uber driver in United Kingdom. Bayo was constantly on the road, but he never kept track of his mileage. Keeper Tax changed that. With the app’s automated expense tracking, Bayo now logs every trip, fuel purchase, and maintenance expense effortlessly. During tax season, he found that his deductions added up to nearly $1,200, same money he would’ve missed out on without Keeper Tax’s automated tracking.

And I could also remembered Blessing, a solopreneur who runs a handmade jewelry business on Instagram. Before Keeper Tax, Blessing had no idea that even her packaging materials and shipping fees could be written off. Once Keeper Tax started identifying these expenses, she was able to reduce her taxable income by nearly 25%. That meant more money to reinvest in her business and less going to the IRS.

7. Ease of Use

Keeper Tax is designed with freelancers in mind, making it incredibly easy to navigate, even if taxes make your head spin.

Imagine this: You’re grabbing coffee between client meetings, and you get a notification on your phone. Keeper Tax just flagged that coffee purchase as a potential business expense. All you have to do is confirm it, and it’s logged. That’s how simple it is.

The app’s mobile-first design is perfect for freelancers who are always on the move. Whether you’re a gig worker, consultant, or creative, you can manage your expenses and deductions right from your smartphone.

Getting started is a breeze. Link your bank account, categorize your expenses, and let Keeper Tax handle the rest. You don’t need to understand complex tax jargon or remember a bunch of tax codes, the app does it all for you. It’s like having a personal tax assistant in your pocket, minus the hefty CPA fees.

8. Pros and Cons of Keeper Tax

| Pros | Cons |

|---|---|

| Designed for Freelancers | Bank Account Linking Required |

| Tailored specifically for freelancers, gig workers, and independent contractors. | Requires connecting your bank account, which may raise privacy concerns for some users. |

| Automated Deduction Tracking | Limited Support for Complex Tax Situations |

| Automatically identifies and categorizes deductible expenses, saving time and maximizing tax savings. | May not be suitable for businesses with complex accounting needs or those requiring advanced features. |

| CPA-Assisted Tax Filing | Additional Fees for Tax Filing |

| Offers the option for a CPA to review your tax return, providing added assurance. | Tax filing services come at an extra cost, which may not be ideal for budget-conscious users. |

| User-Friendly Mobile App | Customer Support Limitations |

| Highly rated mobile app available on iOS and Android, making expense tracking convenient on the go. | Some users have reported challenges in reaching customer support and resolving issues promptly. |

| Educational Resources | Not Ideal for Larger Businesses |

| Provides access to tax guides and educational content to help users understand deductions and tax filing. | Lacks features necessary for larger businesses, such as payroll management and comprehensive financial reporting. |

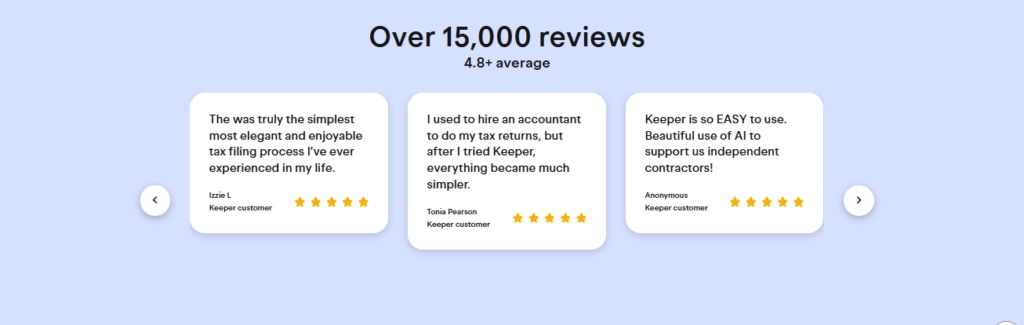

Overall, Keeper Tax is a valuable tool for freelancers seeking to streamline their tax processes and maximize deductions. However, it’s essential to consider the potential drawbacks, especially if you have more complex tax needs or prioritize extensive customer support.

9. How Keeper Tax Compares to Other Tax Tools

When it comes to tax software, freelancers have several options, but not all are created equal. Let’s compare Keeper Tax, TurboTax, and H&R Block to see how they stack up for freelancers.

9.1 Features Comparison

| Feature | Keeper Tax | TurboTax Self-Employed | H&R Block Self-Employed |

|---|---|---|---|

| Target Audience | Freelancers, gig workers, independent contractors | General public, including freelancers | General public, including freelancers |

| Expense Tracking | Automated daily scanning of bank transactions for deductions | Manual entry or import; offers QuickBooks integration | Manual entry; offers some guidance |

| Deduction Identification | AI-driven, real-time deduction suggestions | Guided prompts during tax filing | Guided prompts during tax filing |

| Tax Filing | In-app filing with CPA review option | In-app filing with optional live CPA assistance | In-app filing with optional live CPA assistance |

| Audit Protection | Included with certain plans | Available at additional cost | Available at additional cost |

| Mobile App | Highly rated, user-friendly | Available, integrates with QuickBooks Self-Employed | Available |

| Pricing Transparency | Clear, flat-rate pricing | Tiered pricing with potential upsells | Tiered pricing with potential upsells |

| Average Additional Savings | Users report uncovering an average of $1,249 in extra deductions | Varies; depends on user input and thoroughness | Varies; depends on user input and thoroughness |

| Best For | Freelancers seeking automated deduction tracking and simplified tax filing | Individuals wanting a comprehensive tax solution with extensive support options | Individuals preferring a balance between DIY and professional assistance |

9.2 Why Freelancers Choose Keeper Tax

While TurboTax and H&R Block are robust platforms catering to a broad audience, Keeper Tax stands out for its freelancer-centric approach. Its automated expense tracking and AI-driven deduction identification mean less manual work and potentially more savings. The platform’s clear pricing and mobile-friendly design further enhance its appeal to freelancers who value efficiency and transparency.

10. Conclusion

Freelancers lose thousands each year by missing simple deductions like home office expenses and mileage. Keeper Tax changes that by automating deduction tracking, estimating quarterly taxes, and offering tax filing support, all in one place. Instead of scrambling during tax season or overpaying a CPA, you can keep more of what you earn effortlessly. Try keeper tax today

“If you freelance, don’t just work hard — keep more of what you earn. Try Keeper Tax today and stop leaving money on the table.”

Want to maximize your earnings as a freelancers/small business owner? Check out these related posts to boost your financial game:

- Vibe Coding: The Future of Software Development — Stay ahead with emerging coding trends.

- Lendio Business Loans: Unlocking Freelance/Business Funding — Access funding tailored for freelancers and small businesses.

- FreshBooks vs Wave: Which Invoicing Software is Best for Freelancers — Simplify your invoicing and get paid faster.

- HubSpot vs Zoho: Which CRM is Better for Startups? — Manage client relationships without the hassle.

- Shopify vs WooCommerce Comparison: Which One is the Best? — Choose the right platform to sell your digital products.

Pingback: Zoho Books Accounting: The Best Startup Software Nobody Talks ..