Table of Contents

- Introduction

- Quick Overview: FreshBooks vs Wave

- Features Comparison: FreshBooks vs Waves

- Pricing and Plans

- Ease of Use: FreshBooks vs Wave

- Integrations: FreshBooks vs Wave

- Customer Support: FreshBooks vs Wave

- Pros & Cons: FreshBooks vs Wave

- Who Should Use which Platform?

- Final Verdict: FreshBooks vs Wave

1. Introduction

As a freelancer, keeping your finances organized is just as important as delivering great work. And that all starts with having reliable invoicing software. The right tool doesn’t just help you get paid faster — it also saves time, reduces errors, and keeps your business looking professional.

Two of the most popular invoicing tools on the market are FreshBooks and Wave. While they both offer solid features tailored for freelancers, they cater to slightly different needs and business stages.

In this comparison, we’ll break down the key differences between FreshBooks and Wave to help you decide which one fits your freelance workflow best.:

2. Quick Overview: FreshBooks vs Wave

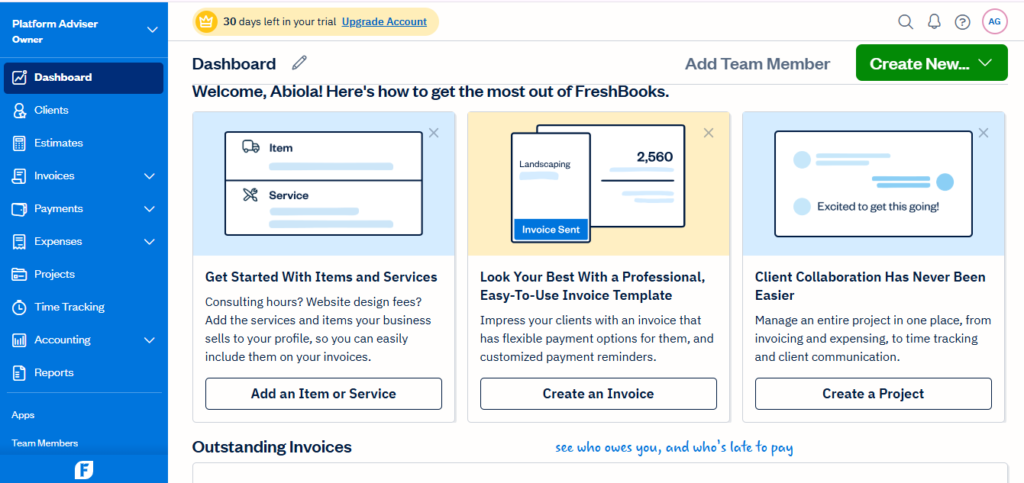

FreshBooks is a cloud-based invoicing and accounting software built with freelancers and small business owners in mind. It offers a clean interface, customizable invoices, time tracking, and strong client management tools — making it a great choice for service-based professionals who want more than just invoicing. Visit Freshbooks’s site

Wave, on the other hand, is a completely free invoicing and accounting tool designed for freelancers and small businesses with simple needs. It’s easy to use, budget-friendly, and comes with essential features like invoicing, receipt scanning, and basic reporting — all at no monthly cost.

side-by-side comparison to give you a quick snapshot of what each platform brings to the table:

| Feature | FreshBooks | Wave |

|---|---|---|

| Pricing | Starts at $19/month (Lite plan) | Free (pay only for payment processing) |

| Best For | Freelancers who need invoicing + time tracking | Beginners or budget-conscious freelancers |

| Key Features | Invoicing, time tracking, expenses, reporting | Invoicing, receipts, basic accounting |

| Integrations | Zapier, Stripe, GSuite, Gusto, Trello, Shopify and 100+ | PayPal, Stripe, Google Workspace, Zapier |

| Customer Support | Phone, email, live chat, knowledge base | Email, knowledge base only |

| Rating (G2/Capterra) | 4.5/5 ⭐ | 4.3/5 ⭐ |

3. Features Comparison: FreshBooks vs Wave

| Feature | FreshBooks | Wave |

|---|---|---|

| Invoicing | Highly customizable invoices, recurring billing, late payment reminders | Simple, professional invoices with basic customization |

| Payments & Processing | Accepts credit cards, ACH payments, integrates with Stripe & PayPal | Accepts credit cards & bank payments via Stripe & PayPal |

| Expense Tracking | Built-in receipt capture, categorize expenses, auto-import from bank | Expense tracking with receipt uploads, basic categorization |

| Client Management | Client portal, add notes, track communication | Basic client tracking, no client portal |

| Reporting & Analytics | Detailed reports: profit & loss, tax summary, invoice insights | Basic financial reports: income/expense, sales tax report |

| Mobile App | Full-featured mobile app for iOS and Android | Functional mobile app with limited features |

4. Pricing and Plans

When it comes to choosing invoicing software, pricing is always a major factor, especially for freelancers who need to keep costs manageable.

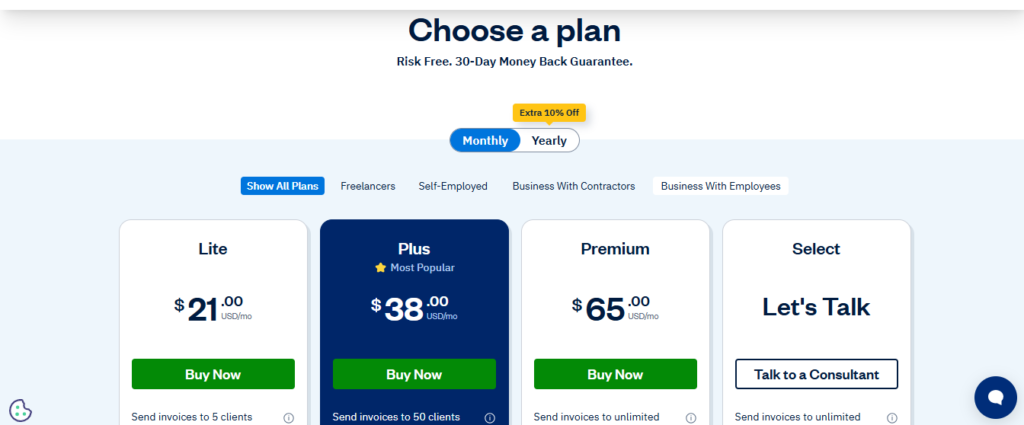

FreshBooks offers a tiered pricing structure, designed to fit freelancers at different stages of their business. Here’s a breakdown of their plans:

- Lite Plan ($21.00/month): The entry-level plan, which includes invoicing, time tracking, and basic expense tracking. Perfect for freelancers who need to send a few invoices a month.

- Plus Plan ($38.00/month): This plan adds more features, including the ability to manage multiple clients and projects, automate invoicing, and track expenses more effectively.

- Premium Plan ($65.00/month): Ideal for growing businesses, it offers everything in the Plus plan, along with the ability to bill unlimited clients, advanced reporting, and more.

The good news is FreshBooks offers a 30-day free trial for new users to test things out before committing. This is a great way to explore the platform and see if it fits your needs.

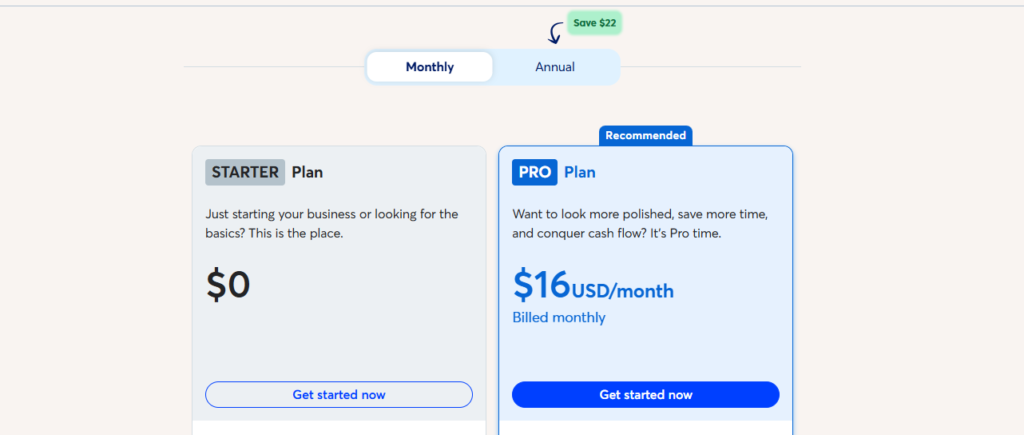

On the other hand, Wave takes a very different approach to pricing — they keep things simple by offering everything for free. That’s right, you can use Wave’s invoicing, accounting, and receipt scanning features without paying a single cent.

But here’s the catch: While you don’t pay for the software itself, Wave does charge a small fee for payment processing. For instance, if you’re accepting credit card payments, you’ll be charged a 2.9% + 30¢ fee per transaction. If you’re accepting ACH payments, the fee drops to 1% per transaction (up to $1). This fee structure kicks in only when you start receiving payments through Wave, so if you’re just using it for invoicing, you won’t incur any costs.

5. Ease of Use: FreshBooks vs Wave

As a freelancer, you want software that makes your life easier, not one that requires hours of tutorials just to send an invoice. That’s why ease of use is such an important factor when choosing between FreshBooks and Wave.

FreshBooks is well-known for its clean, intuitive interface. From the moment you sign up, you’re guided through a simple onboarding process that walks you through setting up your profile, adding clients, and creating your first invoice. The dashboard is easy to navigate, and even first-time users can find their way around without feeling overwhelmed. Features like drag-and-drop invoice customization and clear navigation menus make it ideal for users who want a professional tool without the technical headache.

Wave, on the other hand, keeps things even more minimal. The platform has a very simple layout which is perfect for freelancers who just want to get in, send an invoice, and get out. There’s no steep learning curve, and most of the tools are self-explanatory. However, because it’s more stripped-down, you won’t find as many advanced options or customizations compared to FreshBooks.

6. Integrations: FreshBooks vs Wave

Integrations can save freelancers a ton of time by connecting their invoicing software to other tools they already use — whether it’s for payments, productivity, or communication.

FreshBooks shines when it comes to integrations. It connects seamlessly with popular apps like Stripe, PayPal, Trello, Slack, Shopify, Zoom, Gusto, and even Google Workspace. This means you can track time on Trello, automate payments via Stripe, or manage payroll with Gusto — all without switching platforms. If your freelance workflow depends on multiple tools, FreshBooks helps tie everything together nicely.

Wave also supports essential integrations, though it’s not as extensive as FreshBooks. You can still connect to key services like PayPal, Stripe, Google Workspace, and use Zapier to build custom workflows with hundreds of other apps. It covers the basics, especially for freelancers who don’t need too many bells and whistles.

7. Customer Support: FreshBooks vs Wave

When issues pop up, solid support can save the day. FreshBooks offers top-notch customer service with phone, email, and a detailed help center. What sets it apart? You can actually speak to a real human — no bots, no long holds.

Wave, being a free tool, keeps things simpler. You’ll get access to their help center, community forum, and email support. But live chat and phone support are limited to paid users (like those using Wave Payments or Payroll).

In short: FreshBooks gives you faster, human help; Wave keeps it basic unless you’re paying.

8. Pros and Cons: FreshBooks vs Wave

| Platform | ✅ Pros | ❌ Cons |

|---|---|---|

| FreshBooks | – Professional invoicing features – Built-in time tracking – Great customer support – Mobile-friendly app | – Paid plans only – Limited features on the cheapest tier – Some learning curve for beginners |

| Wave | – Completely free for invoicing & accounting – Easy to use interface – Built-in receipt scanning – Good for basic needs | – No time tracking – Limited support options – Not ideal for scaling or teams |

9. Who Should Use which Platform?

FreshBooks is a great fit for freelancers who are starting to scale their business and need more than just simple invoicing. If you’re offering services that require time tracking, project management, or detailed expense tracking, FreshBooks can help you stay organized and look professional. It’s also ideal for agencies, consultants, and service providers who manage multiple clients and want robust reporting and automation.

If you’re ready to invest in a tool that grows with you, FreshBooks is the way to go.

While Wave is perfect for new freelancers, side hustlers, or anyone just getting started who wants to keep things simple — and free. If all you need is clean, professional invoicing without the extra features (and costs), Wave is a no-brainer. It’s also great for creatives and hobbyists who need to send the occasional invoice but don’t want to deal with subscriptions or complicated tools.

10. Final Verdict: FreshBooks vs Wave

At the end of the day, both FreshBooks and Wave are solid invoicing tools — but they cater to different types of freelancers.

👉 Go with FreshBooks if you’re scaling your freelance business, need advanced features like time tracking, expense reports, and want reliable, hands-on support. It’s built for professionals ready to invest in growth.

👉 Stick with Wave if you’re just getting started, working part-time, or simply need basic invoicing without monthly fees. It covers the essentials and keeps things simple — perfect for new freelancers or side hustlers.

Remember, choosing the right invoicing software is more than a tech decision — it’s a step toward managing your time, money, and business more efficiently.

“Choosing the right invoicing software is a small step that leads to big growth. Pick the one that matches your freelance journey.”

💡 Related Posts You’ll Love

Here are more helpful reads if you’re comparing business tools:

- Sage vs. QuickBooks: Which Accounting Software Is Right for Your Business?

Dive into a detailed comparison of two top accounting platforms and find out which fits your business needs best. - PayPal vs Stripe Comparison

A side-by-side look at two popular payment gateways and how they stack up for freelancers and small businesses. - Vibe Coding: The Future of Software Development

Explore how intuitive, AI-assisted development is changing the coding landscape — and what it means for the next generation of software creators. - HubSpot vs Zoho: Which CRM Is Better for Startups?

We break down the features, pricing, and ease of use to help startups pick the right customer relationship management tool.

Pingback: Taskade vs Reflect – Best AI Productivity Tools for Remote Teams

Pingback: Lendio Business Loans: Unlocking Freelance/Business Funding - Platform Adviser