By Abiola Gbolahan

Edited By Fredrick Oladipupo

- Introduction

- Criteria for Selecting the Top Payment Gateways

- Gateway 1: PayPal

- Gateway 2: Stripe

- Gateway 3: Square

- Gateway 4: Paystack

- 6.1 Transaction fees in Nigeria and beyond, with a focus on local markets.

- 6.2 Advantages for small businesses operating in Africa and developing regions.

- 6.3 Paystack’s features, integrations with local banks, and overall ease of use.

- 6.4 Why Paystack’s low fees make it a great choice for local businesses.

- Gateway 5: Authorize.Net

- 7.1 Transaction fees and available plans for small businesses.

- 7.2 Key selling points: Flat-rate pricing and robust customer support.

- 7.3 How Authorize.Net compares with other gateways in terms of hidden fees and ease of use.

- 7.4 Why Authorize.Net is considered an affordable option for growing businesses.

- Comparison Table:

- How to Choose the Right Payment Gateway for Your Business.

- Conclusion: Final thoughts on selecting the best payment gateway based on transaction fees.

1. Introduction

Choosing the best payment gateway for businesses is important for small businesses aiming to maximize profits. Every transaction fee eats into revenue, so finding a gateway with low costs can make a significant difference. Lower transaction fees mean more income retained per sale which is very vital for businesses working with tight margins.

In this blog, we’ve reviewed top 5 best payment Gateway for Businesses like PayPal, Stripe, Square, Paystack, and Authorize.Net, all known for their affordable fees and business-friendly features. Each option has unique advantages, but they share one goal: helping small businesses keep more of what they earn. This blog will give you a clear sense of which gateway best suits your needs, ensuring a cost-effective solution for your business.

2. Criteria for Selecting the Top Payment Gateways

2.1 Factors to be Considered

When evaluating best payment gateway for Businesses, we looked closely at four important factors: transaction fees, hidden fees, setup costs, and customer support. Transaction fees determine how much revenue businesses keep per sale, while hidden fees—like currency conversion and refund costs—can surprise users with extra charges. Likewise, Setup costs impact upfront investment, and customer support ensures you have access to help when it’s needed most. Together, these factors influence not only cost but also a business’s day-to-day payment experience.

2.2 Why Transaction Fees Are a Important Factor for Small Businesses

For small businesses, transaction fees can have a big impact on profitability. High fees take a cut from every sale, which can quickly add up for businesses with thin margins. By choosing a gateway with lower fees, small businesses can retain more revenue, making these fees a crucial factor when comparing options. In this blog, we’ve highlighted gateways with low fees to help you get the most value from each transaction.

2.3 How Gateway Features Affect Business Operations Beyond Just Fees

While fees are important, a gateway’s features can be just as important for smooth operations. Features like easy integration, security, and support for various payment methods help streamline processes and enhance customer experience. For instance, gateways that support multiple payment types allow businesses to reach more customers, while robust security features protect against fraud. Choosing a gateway with the right features ensures you’re not only saving on fees but also supporting efficient and effective business operations.

3.Gateway 1: PayPal

3.1 Transaction Fees for Domestic and International Payments

PayPal charges different fees depending on whether a payment is domestic or international. For domestic transactions within the same country, the fee generally ranges between 2.9% + $0.30 per transaction, though this rate can vary depending on the account type and country. For international payments, PayPal typically adds a cross-border fee, raising the transaction cost by approximately 1.5%, making it more costly for global transactions.

3.2 Additional Fees (Chargebacks, Refunds, and Currency Conversion)

Apart from transaction fees, PayPal also imposes other fees that businesses should consider. Chargebacks, for example, come with a standard fee of $20 per disputed transaction if the buyer’s claim is upheld. For refunds, PayPal keeps the fixed portion of the transaction fee ($0.30), though the percentage-based portion is returned. Additionally, PayPal charges a currency conversion fee that typically adds around 3-4% to the transaction value, impacting businesses with international clientele.

3.3 Overview of Features and Usability for Small Businesses

PayPal offers a comprehensive set of tools ideal for small businesses, including invoicing, subscription management, and integration with major e-commerce platforms. Its user-friendly interface makes it easy for small businesses to manage payments without requiring extensive technical expertise. PayPal’s reach and brand recognition also help businesses build trust with customers, particularly in international markets.

3.4 Why PayPal Makes the List Despite Some Fees Being Higher in Certain Markets

Despite its sometimes higher fees, PayPal’s reliability, global recognition, and robust security features make it a strong contender for small businesses. Its vast network provides unparalleled access to international customers, and PayPal’s buyer protection policies can build customer trust, which is invaluable for smaller businesses looking to expand their customer base globally. For businesses seeking a balance between functionality and accessibility, PayPal remains a popular and dependable choice.

4. Gateway 2: Stripe

4.1 Transaction Fees Breakdown, Including Competitive International Pricing

Stripe’s transaction fees for domestic payments are generally around 2.9% + $0.30 per transaction, similar to PayPal. However, Stripe offers competitive pricing for international payments, with fees typically set at 3.9% + a fixed fee that varies by country. This pricing structure is attractive for businesses with a significant international customer base, as it allows them to manage costs more effectively compared to some competitors.

4.2 Key Features Like No Monthly Fees and Transparent Pricing

One of Stripe’s major advantages is that it does not charge monthly fees, making it an appealing option for small businesses that want to avoid ongoing costs. Its pricing model is transparent, with no hidden fees for setup or maintenance. This clarity helps businesses better forecast their payment processing costs and maintain budgetary control, allowing them to allocate funds toward growth and other operational expenses.

4.3 Overview of Stripe’s Customizable Options.

Stripe is renowned for its robust API, allowing businesses to customize their payment solutions to fit specific needs seamlessly. This level of customization is particularly beneficial for tech-savvy small businesses looking to create unique user experiences. With features such as subscription billing, invoicing, and advanced reporting tools, Stripe empowers businesses to create tailored payment workflows that enhance customer satisfaction and operational efficiency.

4.4 How Stripe Stacks Up Against Other Low-Fee Payment Gateways

When compared to other low-fee payment gateways, Stripe often stands out due to its versatility and developer-friendly nature. While some competitors may offer lower base rates, they often lack the extensive features and flexibility that Stripe provides.

Additionally, Stripe’s commitment to transparency and lack of monthly fees make it an attractive option for small businesses that may be sensitive to hidden costs. Overall, Stripe presents a strong alternative for businesses looking for a balance between affordability and advanced features, especially in a rapidly evolving digital landscape.

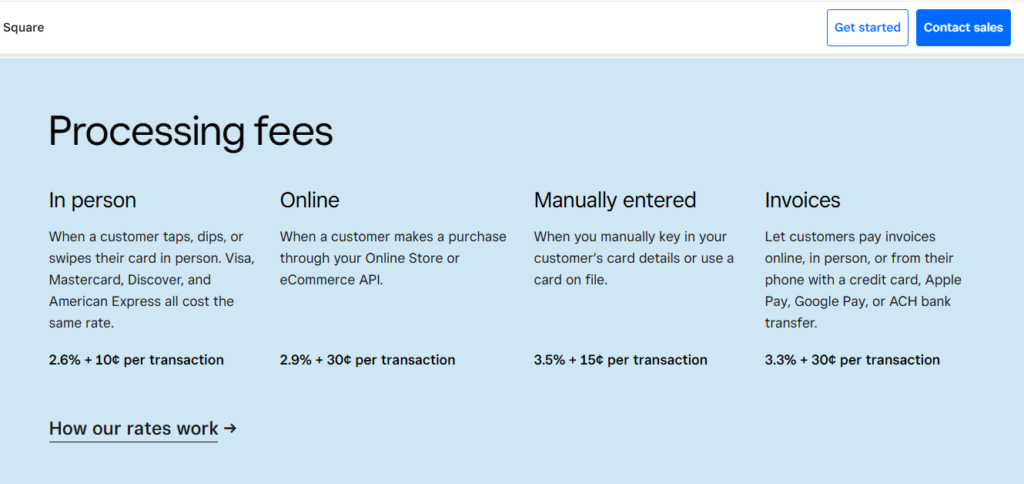

5. Gateway 3: Square

5.1 In-Person and Online Transaction Fees for Small Businesses

Square charges a flat rate for transaction fees, which is currently set at 2.6% + $0.10 for in-person payments and 2.9% + $0.30 for online transactions. This straightforward pricing structure allows small businesses to easily calculate their costs without worrying about complicated fee tiers. Additionally, Square does not charge for chargebacks, making it a cost-effective choice for businesses processing a high volume of payments.

5.2 Benefits of Square’s POS Systems and How They Integrate with Low-Fee Processing

Square offers a powerful Point of Sale (POS) system that is user-friendly and suitable for various types of businesses. The system integrates seamlessly with Square’s payment processing, allowing small businesses to manage both in-person and online sales efficiently. The POS system also includes features like inventory management, sales tracking, and customer relationship management, enhancing operational efficiency. This integration of low-fee processing with robust POS capabilities helps businesses streamline their operations and reduce costs.

5.3 Additional Features: No Monthly Fees, Competitive Hardware Pricing

One of Square’s standout features is that it imposes no monthly fees, making it particularly appealing for small businesses that want to avoid ongoing expenses. Square also offers competitively priced hardware, including card readers and terminals, which enable businesses to accept payments without significant upfront investment. This affordability makes it accessible for startups and small enterprises looking to establish a payment processing solution without breaking the bank.

5.4 Why Square Is Ideal for Businesses with Brick-and-Mortar and Online Operations

Square is an excellent choice for businesses operating both brick-and-mortar locations and online stores due to its versatile nature. Its ability to integrate online and offline sales in one cohesive system allows businesses to maintain consistent inventory and customer data across platforms. This omni channel approach not only simplifies operations but also enhances customer experiences, as businesses can offer flexible payment options whether customers shop in-store or online. For small businesses looking to bridge the gap between physical and digital sales, Square offers an all-in-one solution that is cost-effective and easy to implement.

6. Gateway 4: Paystack

6.1 Transaction Fees in Nigeria and Beyond, with a Focus on Local Markets

Paystack offers competitive transaction fees for businesses operating in Nigeria, typically around 1.5% + ₦100 per transaction for local payments. For international payments, the fee is usually set at 3% per transaction, which remains attractive compared to many global competitors. Paystack’s pricing structure is designed to cater specifically to local markets, making it accessible for small businesses looking to manage costs effectively while processing payments.

6.2 Advantages for Small Businesses Operating in Africa and Developing Regions

For small businesses in Africa and other developing regions, Paystack provides significant advantages by offering localized payment solutions tailored to the unique challenges faced in these markets. Paystack allows businesses to accept various payment methods, including cards, bank transfers, and mobile money, catering to the diverse payment preferences of customers. This flexibility helps businesses maximize their customer base and streamline operations in regions where payment processing can be complex.

6.3 Paystack’s Features, Integrations with Local Banks, and Overall Ease of Use

Paystack boasts an array of features that enhance the payment experience for small businesses. Its user-friendly interface makes it simple for business owners to set up and manage their accounts, and it provides valuable analytics tools for tracking sales and customer behavior.

Additionally, Paystack integrates seamlessly with many local banks and popular e-commerce platforms, simplifying the payment process and ensuring smooth transactions. The platform also supports multiple currencies, further enhancing its usability for businesses with cross-border operations.

6.4 Why Paystack’s Low Fees Make It a Great Choice for Local Businesses

Paystack’s low fees are particularly advantageous for local businesses that may operate on tight margins. By keeping transaction costs manageable, Paystack allows small enterprises to reinvest savings into growth initiatives, product development, or marketing strategies. The platform’s commitment to supporting local businesses through affordable pricing and tailored solutions has made it a trusted choice among entrepreneurs in Nigeria and across Africa, promoting financial inclusion and enabling the growth of the digital economy in the region.

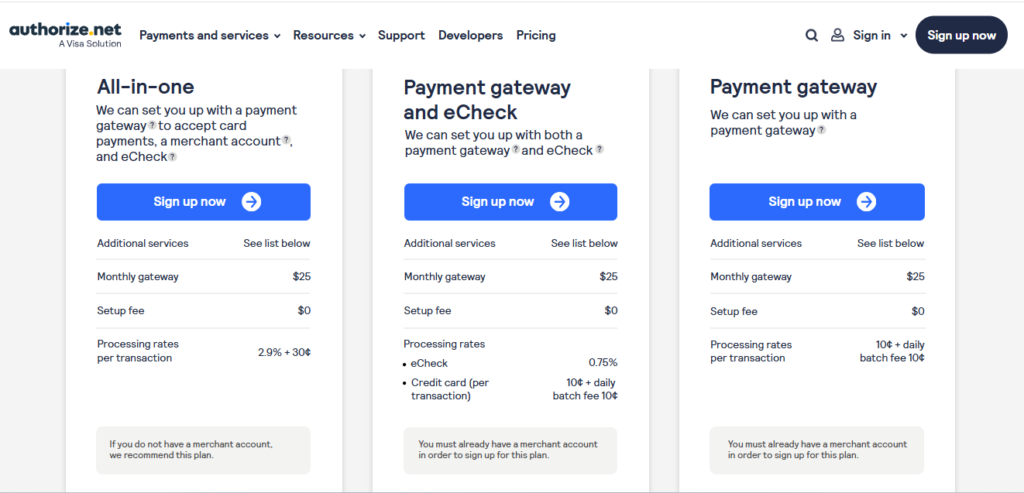

7. Gateway 5: Authorize.Net

7.1 Transaction Fees and Available Plans for Small Businesses

Authorize.Net offers a range of transaction plans suitable for small businesses. The standard transaction fee is typically 2.9% + $0.30 per transaction for card-not-present transactions, similar to many competitors. Additionally, Authorize.Net charges a monthly gateway fee (usually around $25) and a per-transaction fee, which can vary based on the plan chosen. This structure allows businesses to select a plan that best fits their processing volume and budget, making it easier to manage cash flow.

7.2 Key Selling Points: Flat-Rate Pricing and Robust Customer Support

One of Authorize.Net’s key selling points is its flat-rate pricing model, which simplifies billing and helps small businesses predict their monthly expenses accurately. This predictability can be particularly beneficial for growing businesses that need to manage their budgets effectively.

Moreover, Authorize.Net is known for its robust customer support, offering 24/7 assistance via phone and live chat. This level of support ensures that businesses can quickly resolve issues and minimize downtime, which is critical for maintaining customer satisfaction.

7.3 How Authorize.Net Compares with Other Gateways in Terms of Hidden Fees and Ease of Use

Compared to other payment gateways, Authorize.Net is transparent about its fee structure, with fewer hidden costs than some competitors. Many other gateways may have additional charges for features like chargebacks, refunds, or account maintenance. Authorize.Net also provides an intuitive dashboard that makes it easy for business owners to track transactions, manage disputes, and analyze sales data, contributing to an overall positive user experience.

7.4 Why Authorize.Net Is Considered an Affordable Option for Growing Businesses

Despite the monthly fee, Authorize.Net is often viewed as an affordable option for growing businesses due to its comprehensive features and reliability. The platform offers a range of tools for fraud prevention, recurring billing, and customizable checkout experiences, which can help businesses enhance their operations without incurring excessive costs.

Additionally, for businesses that require robust payment processing solutions, Authorize.Net’s ability to handle high transaction volumes efficiently positions it as a cost-effective choice in the long run. With a strong focus on customer service and a user-friendly platform, Authorize.Net remains a compelling option for small businesses aiming to scale their operations.

8. Comparison Table: Breakdown of Fees and Features

| Payment Gateway | Transaction Fees (Domestic) | Transaction Fees (International) | Monthly Fees | Additional Costs | Key Features and Integrations |

|---|---|---|---|---|---|

| PayPal | 2.9% + $0.30 | 4.4% + fixed fee | None | $20 for chargebacks; fixed fee for refunds | User-friendly interface, invoicing, integrations with e-commerce platforms |

| Stripe | 2.9% + $0.30 | 3.9% + fixed fee | None | Chargeback fee varies; competitive currency conversion | Robust API, subscription billing, customizable options, integration with numerous platforms |

| Square | 2.6% + $0.10 (in-person) | 2.9% + $0.30 (online) | None | None for chargebacks; competitive pricing for hardware | Integrated POS system, sales tracking, no monthly fees, and multiple payment options |

| Paystack | 1.5% + ₦100 | 3% | None | None for chargebacks; ₦100 for refunds | Local bank integrations, multiple payment methods, user-friendly dashboard |

| Authorize.Net | 2.9% + $0.30 | 2.9% + $0.30 | $25 | $20 for chargebacks; fees for refunds may apply | Reliable customer support, fraud prevention tools, recurring billing options |

The comparison table above provides a clear overview of each payment gateway’s transaction fees, monthly costs, additional fees, and key features. Small businesses can use this information to assess which gateway aligns best with their financial and operational needs.

9. How to Choose The Best payment Gateway for Businesses

9.1 Factors to Consider Beyond Transaction Fees

When selecting a payment gateway, it’s essential to look beyond just transaction fees. Here are some critical factors to consider:

1. Ease of Integration

Ensure the gateway can easily integrate with your existing website or e-commerce platform. Look for gateways that offer plugins or APIs that match your technical expertise.

2. Customer Support

Reliable customer support is crucial for resolving issues quickly. Consider gateways that provide 24/7 support through various channels (phone, chat, email) and have a reputation for responsive service.

3. Global Reach

If your business plans to sell internationally, select a payment gateway that supports multiple currencies and payment methods prevalent in your target markets.

4. Customization

A customizable payment solution can enhance your brand experience. Look for gateways that allow you to tailor the checkout process to match your branding and customer preferences.

9.2 Best Gateways for Specific Use Cases

Different payment gateways cater to various business needs. Here are some recommendations based on specific use cases:

1. Online Stores: Stripe and PayPal are excellent choices due to their robust e-commerce integrations, customizable checkout experiences, and support for subscriptions.

2. Freelancers: PayPal and Square are ideal for freelancers, offering straightforward payment solutions with minimal setup and no monthly fees.

3. Small Retail Businesses: Square is well-suited for brick-and-mortar businesses due to its integrated POS system, while also supporting online sales without ongoing costs.

Businesses in Africa: Paystack is highly recommended for small businesses operating in Africa, thanks to its local banking integrations and low fees tailored to the region.

9.3 Tips for Keeping Overall Payment Costs Low

To minimize your overall payment processing costs, consider these tips:

1. Choose the Right Plan: Evaluate your transaction volume and select a payment gateway plan that aligns with your business’s needs. Some gateways offer tiered pricing that can lower your costs as your business grows.

2. Avoid Hidden Fees: Carefully review the fee structure of each payment gateway to identify any hidden costs, such as chargeback fees, refund processing fees, or currency conversion costs. Choose a gateway that provides transparency in its pricing model.

3. Negotiate Fees: If you anticipate high transaction volumes, reach out to payment processors to negotiate lower rates based on your expected business growth. Many gateways are open to discussions, especially with growing businesses.

4. Monitor Your Transactions: Regularly review your payment processing statements to identify any unexpected fees or discrepancies. This will help you make informed decisions and address issues promptly.

10. Conclusion: Best payment Gateway for Businesses

Choosing the best payment gateway involves more than just looking at transaction fees. While costs are crucial, it’s equally important to consider features, ease of integration, and customer support. Weigh both costs and functionalities to find the gateway that perfectly suits your business needs.

For deeper insights, check out our comparisons of PayPal vs. Stripe and Paystack vs. Flutterwave to help you make an informed decision. Remember, the right choice can streamline your operations, enhance customer satisfaction, and ultimately drive your success!

Pingback: Stripe vs PayPal: Which payment platform is best for businesses ?